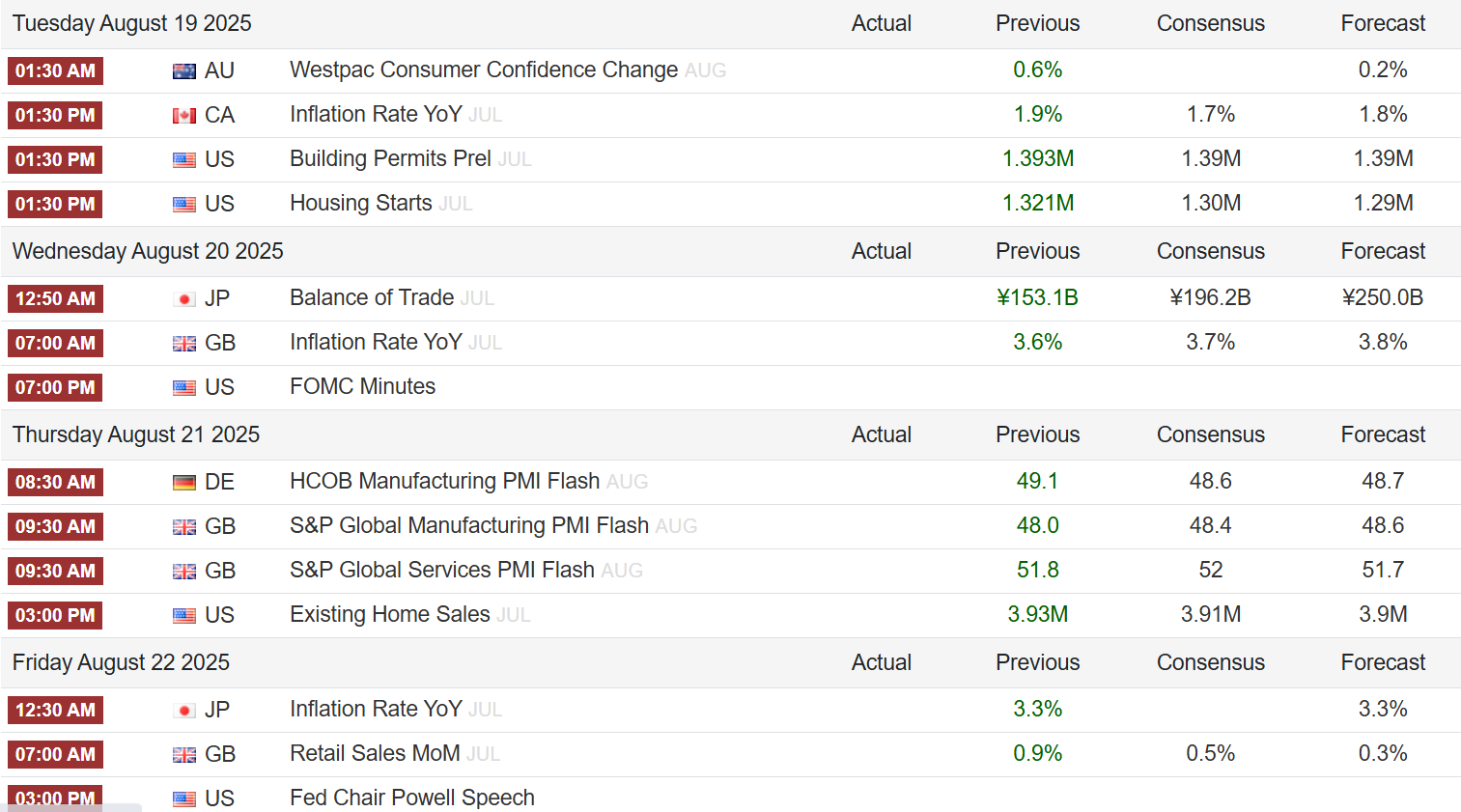

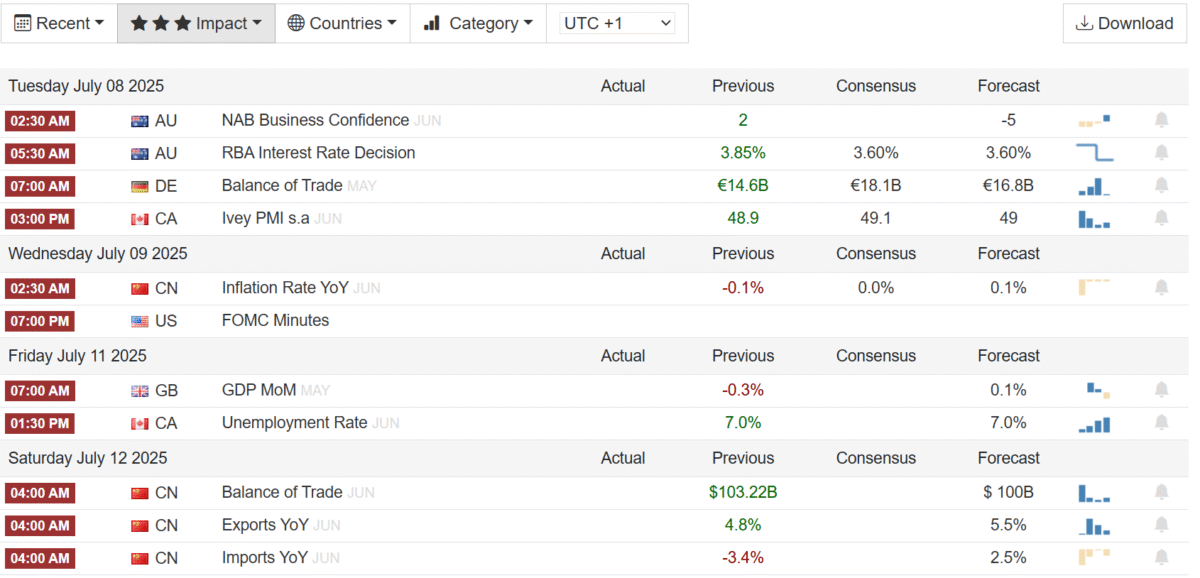

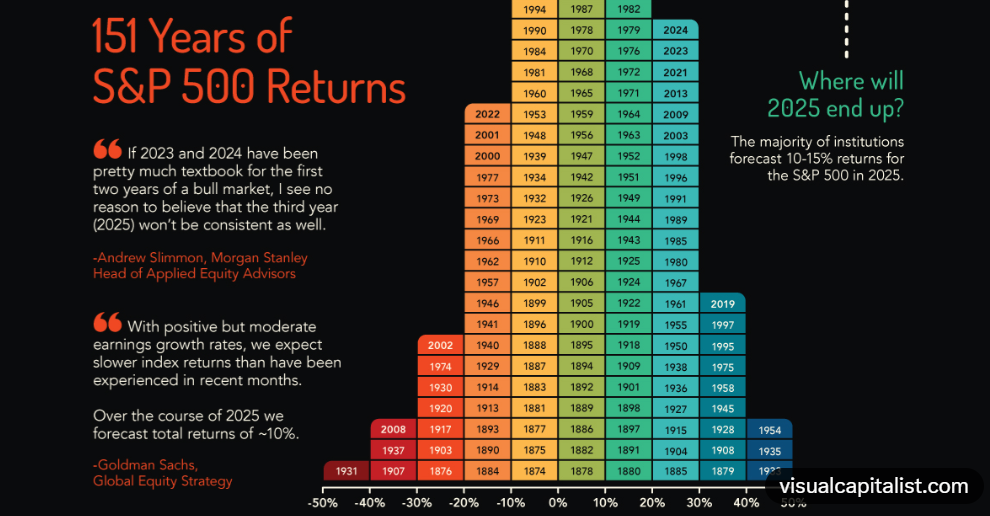

The stock market 2025 review reveals a year of remarkable resilience amid AI-driven growth, tariff uncertainties, geopolitical tensions, and Federal Reserve policy shifts. Major U.S. indices delivered strong double-digit gains, with the S&P 500 rising approximately 16-17%, marking its third consecutive year of robust performance. Precious metals dominated headlines, as gold climbed over 65% and silver soared more than 144%. Bitcoin ended the year near $88,000, down slightly after earlier peaks above $126,000.Despite a late-year pullback in thin holiday trading, the stock market 2025 review shows overall strength, closing near record highs with cautious optimism for 2026.

S&P 500 Daily Performance Chart for 2025

- Bullish Signals:

- Long-term uptrend intact in major indices.

- Potential “January Effect” rally in undervalued small-caps and beaten-down sectors.

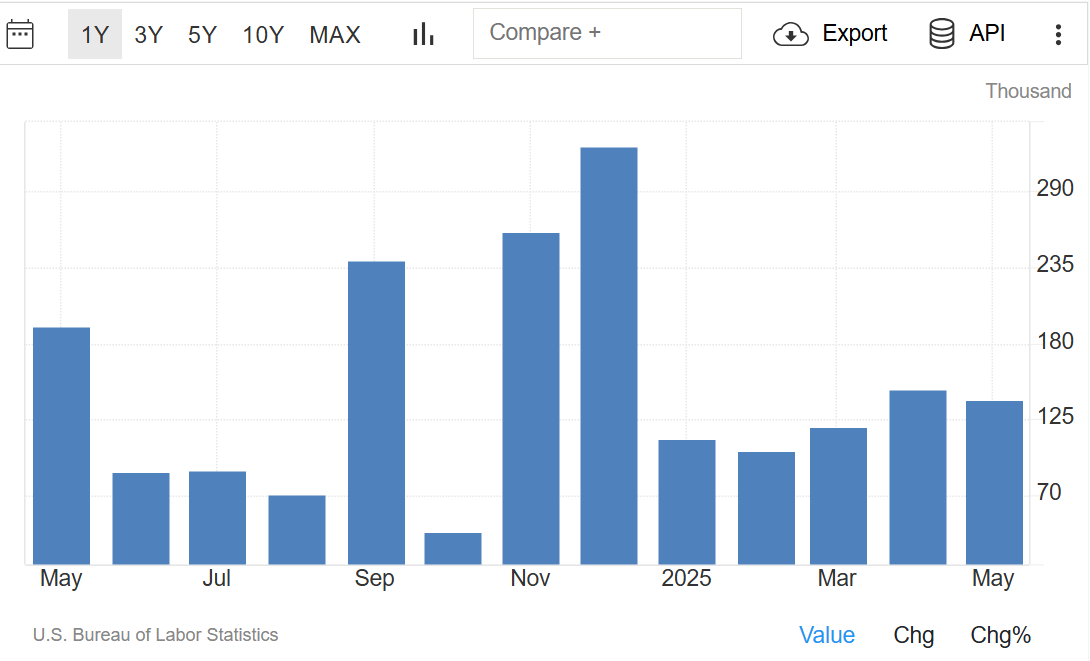

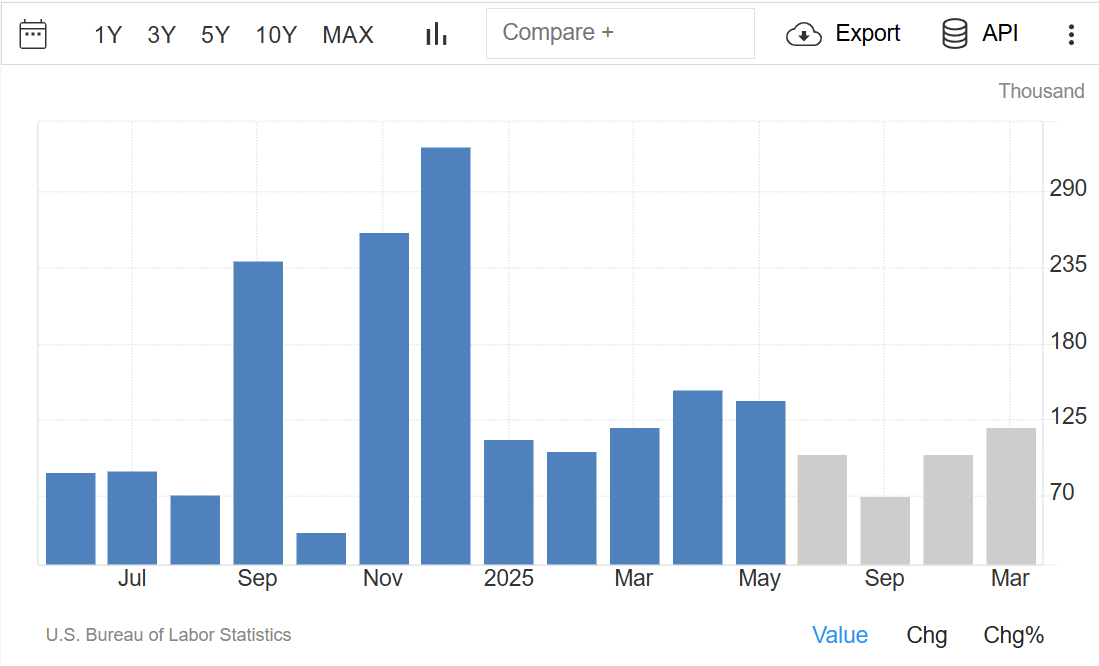

- Support from expected Fed rate stability or cuts if labor market softens.

- Bearish Signals:

- Short-term momentum weakening with four-session losing streak ending the year.

- Risk of correction if inflation reaccelerates or tariffs escalate.

- RSI indicators showing potential exhaustion in tech-heavy names.

Recommendation: Maintain diversified exposure with a tilt toward quality large-caps. Monitor for breakout above recent highs (bullish confirmation) or breakdown below December lows (bearish).Disclaimer: This analysis is for informational purposes only and not investment advice. Markets are volatile; consult a financial advisor.