What Many Traders Overlook

New to trading? Feeling overwhelmed by how much there is to learn in order to be consistently profitable? Which broker do I invest with? Do I have a Strategy? Do I use Technical or Fundamental Analysis?

Overnight Fees, Spreads, Commissions, Tick Value, Margin Allocation. There are many things to learn about and be aware of in regards to the Cost of Trade before you enter a position.

If you don't consider all of these factors or fees, you will not last longer than 3-6 months in the market.

Overnight Fees also known as "Swaps" are definitely the most overlooked by newbies.

It is costly to hold trades for longer periods of time due to the Swaps. This common oversight in the Forex market can make it difficult for traders to make informed decisions and ultimately leads to losses. Traders must be aware of the costs of trading, this is one reason why we developed our software and service. To teach them about Cost of Trade and to provide the solution. Also so traders can use our Carry Trading Systems to lower risks and to generate returns in the form of Swaps.

Get Paid to Trade, Be a Swap Hunter!

Benefits at a glance

Monthly Subscription

Installation, 5 FREE training sessions, ongoing technical support.

Lifetime License

Installation, 15 FREE training sessions, ongoing technical support.

Designed for

Long-Term Investors

can benefit from earning swaps by holding positions for extended periods and staying hedged to reduce risks. By using 'Swap Hunter', they can analyze the swaps offered by various brokers and choose the one that provides the best returns. Additionally, they can use the tool to monitor their positions and ensure that they remain hedged to avoid losses. Ultimately, earning swaps can be a valuable source of passive income for long-term investors in the Forex market.

Novice Traders

can minimize risks and make informed decisions. Swap Hunter analyses currency pairs to find those that offer the highest overnight swaps. By identifying these currency pairs, 'Swap Hunter' gives traders an edge over the market. With the right skills, knowledge, and experience, traders can make informed decisions and achieve financial freedom. With the help of this tool, novice traders can gain confidence in their trades and reduce the risks associated with Forex trading.

Forex scalpers and day traders

can use 'Swap Hunter' to analyze currency pairs, traders can identify those with the best overnight swaps, which can help them maximize profits in the short term while minimizing the cost of holding trades. Additionally, 'Swap Hunter' can monitor positions to ensure that they remain hedged and avoid losses. With 'Swap Hunter', Forex scalpers and day traders can gain an edge over the market and brokers and achieve financial freedom in the short term.

PAMM/MAM managers

have a responsibility to secure their clients' funds and generate steady mid- and long-term profits. By using 'Swap Hunter' to analyze currency pairs, managers can find those with the best overnight swaps, which can help maximize profits while minimizing the cost of holding trades. Additionally, they can monitor positions to ensure that they remain hedged and avoid losses, reducing the risk of losing clients' funds.

Ways to use Carry Trading to generate profits

Investment Strategy "Hold the hedge"

Strategy suitable for Investing with focus on capital preservation. Build up profits steady and beat inflation by collecting the overnight swaps and the weekly triple rollover. Lower the risks of trading in the financial markets significantly through hedging.

Investment Strategy "Release the Hedge"

Strategy for experienced traders, who are looking for higher profits. Generate quicker and higher returns but with higher risk. Profit from accumulated Swaps and banking profits on the winning side of the hedge. Then recovering the losses from losing side of the hedge.

New option: Swap Hunter PAMM

We have created a PAMM investment account for Investors without previous trading experience. The Swap Hunter PAMM is utilising all the Carry Trading strategies: Hold the Hedge, release the hedge and tripple rollover, banking Profits and let the P&L float.

Get your Edge over the Market

Testimonials

Senior Manager, PAMM Investor

"I was looking for a good investment opportunity in a low interest market. With no experience in Forex or trading. I prefer slow and steady returns, which Swap Hunter provide. Protecting my equity against inflation is my priority and gain a little extra interest."

Professional Trader

"Carry trading is not new, but with Swap Hunter it is easier than ever to facilitate this strategy. It is used by institutional level investors and the banks. I've not seen a tool like this for MT4 and it is very powerful, if you implement it in your investment portfolio"

Joao Monteiro

CEO 4XC.com

"Partnering up with Swap Hunter has proven to be extremely successful. As we see traders looking for alternative trading techniques and styles, Swap Hunter provide some of the best tools for this. We can give our traders swap correlation, carry trading indicators and much more. "

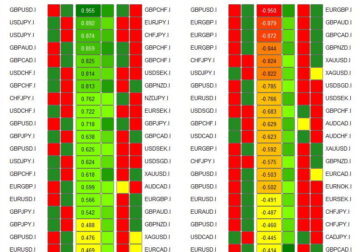

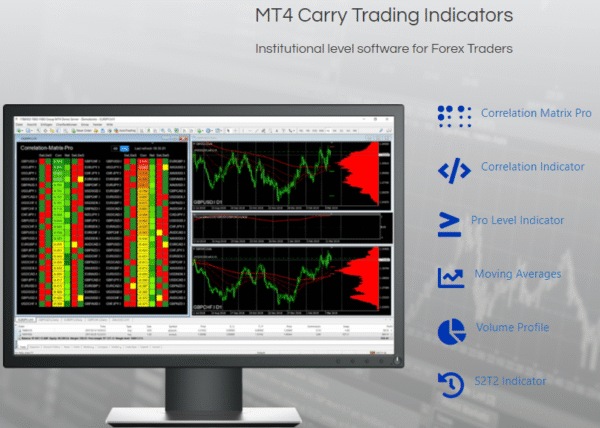

Strong combination of MT4 indicators

Included in the Swap Hunter MetaTrader 4 package

Stock Market 2025 Review: Key Performance Highlights and Trading Signals

The stock market 2025 review reveals a year of remarkable resilience amid AI-driven growth, tariff uncertainties, geopolitical tensions, and Federal Reserve policy shifts. Major U.S. indices delivered strong double-digit gains, with the S&P 500 rising approximately 16-17%, marking its third consecutive year of robust performance. Precious metals dominated headlines, as gold climbed over 65% and … Read more

Global Market Update

Labor Market Corporate Highlights Germany – Export Data (October 2025) Get Your Edge over the Markets and Beat the Banks with the Swap Hunter Strategies. You will receive support our team of well seasoned traders, economists and analysts. Simply register on our site or contact us on WhatssApp, Telegram, Phone or Email to discuss everything … Read more

Paul Tudor Jones Says Ingredients Are in Place for Massive Rally Before a ‘Blow-Off’ Top

Billionaire hedge fund manager Paul Tudor Jones believes the stock market is poised for a powerful surge before reaching the final phase of its bull run. Speaking on CNBC’s Squawk Box, the Tudor Investment founder said that today’s market setup feels strikingly similar to the one seen in late 1999, just before the dot-com bubble … Read more

Gold rallies as weak US jobs data, tariffs stoke stagflation fears

Gold price reverses its course and registers solid gains on Thursday as the latest round of jobs data in the US points to a weakening labor market. Consequently, investors increased their dovish bets as the Fed is expected to resume its easing cycle in September. The XAU/USD trades at $3,385, up 0.45%. Earlier, the Department … Read more

Pound Sterling falls against US Dollar despite “PARTIAL” US government shutdown

The Pound Sterling (GBP) trades 0.3% lower to near 1.3440 against the US Dollar (USD) during the European trading session on Monday. The GBP/USD pair faces selling pressure as the US Dollar rebounds strongly despite growing risks that the White House would be forced to make mass lay-offs in the wake of a partial United … Read more

Silver Price Forecast: XAG/USD Retreats Below $38.50 Amid Dollar Strength

Silver (XAG/USD) is pulling back after touching recent highs above $39.00. Now trading below $38.50 as the US Dollar extends its rally. The decline comes as the US Dollar Index (DXY) posts gains for the fourth consecutive session. Supported by a weak Euro amid political turmoil in France. Although markets remain cautious about the Federal … Read more

Silver Price Forecast: XAG/USD Rebounds from Two-Week Low Ahead of Fed Minutes

Silver (XAG/USD) rebounds from a two-week low as the US Dollar weakens and traders await the Fed’s July meeting minutes. Will XAG/USD break higher from its symmetrical triangle pattern? Silver Price Rebound Amid Dollar Weakness Silver (XAG/USD) staged a sharp recovery on Wednesday, snapping a four-day losing streak after dropping to its lowest level since … Read more

UK Inflation Jumps to 3.8% in July 2025, Highest in Over a Year

The UK inflation rate rose to 3.8% in July 2025, marking its highest level since January 2024. This was up from 3.6% in June and slightly above market forecasts of 3.7%, according to the Office for National Statistics (ONS). The main driver of the increase came from the transport sector, where prices climbed 3.2% compared … Read more