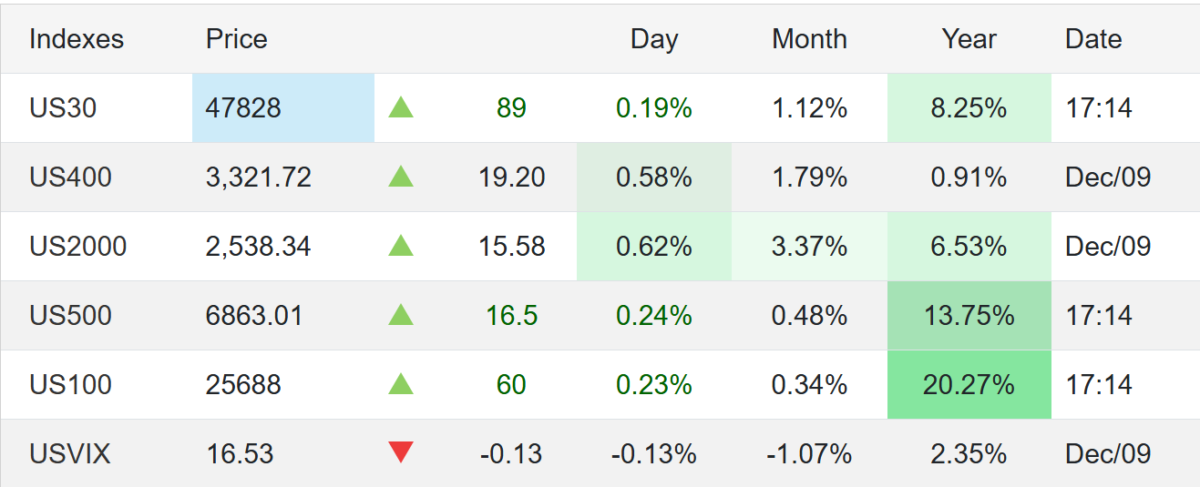

- US equities were mostly flat as traders awaited the Federal Reserve’s interest-rate decision.

- S&P 500: +0.1%

- Dow Jones: +90 points

- Nasdaq: Near unchanged

- Expectations: Markets are widely pricing in a 25 bp rate cut on Wednesday. Focus is shifting to the Fed’s updated economic projections, especially regarding the pace of policy easing in 2026.

Labor Market

- JOLTS (Sept & Oct): Job openings came in above expectations, signaling still-firm demand for labor.

- ADP employment (weekly average through Nov 22):

- Private employers added ~4,750 jobs per week, ending three straight periods of declines.

- Suggests job losses eased in mid-November.

- Official November payrolls:

- –32,000 jobs, largest drop since March 2023.

- Driven mainly by a 120,000-job decline at small businesses. source: U.S. Bureau of Labor Statistics

Corporate Highlights

- Nvidia: –1%

- Reports that China may restrict domestic chip purchases.

- This follows President Trump’s approval for Nvidia to sell H200 chips to China under the condition that 25% of revenue goes to the U.S. government.

- Home Depot: –1%+

- Issued weaker-than-expected 2026 earnings growth guidance.

- M&A Focus:

- Investors monitoring the Paramount–Netflix bidding war for Warner Bros. source: Automatic Data Processing, Inc.

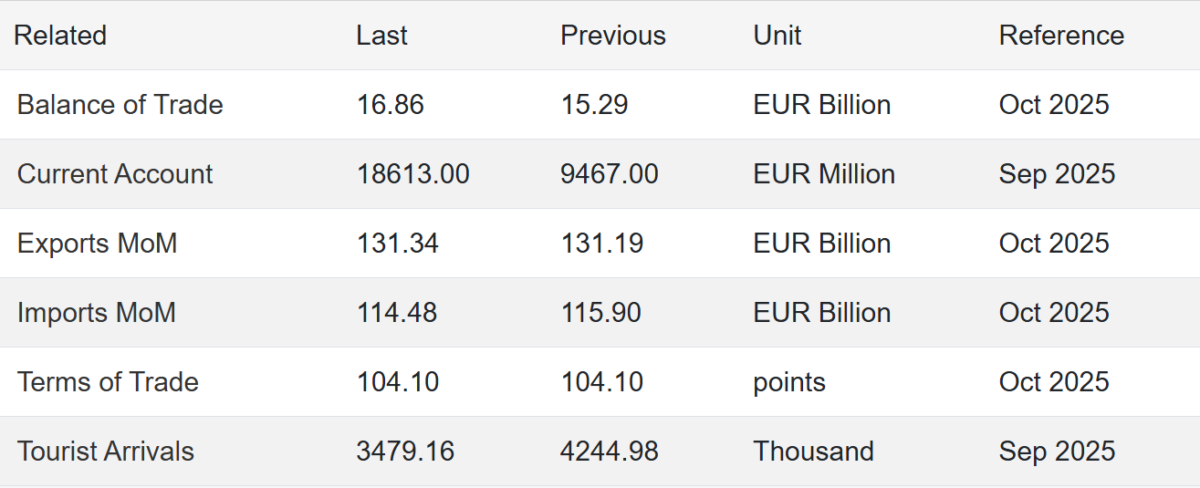

Germany – Export Data (October 2025)

- Exports: +0.1% MoM to €131.3B, a 6-month high (vs. –0.2% expected).

- Regional breakdown:

- EU exports: +2.7%

- Euro area: +2.5%

- Non-euro EU: +3.1%

- Third-country exports: –3.3%

- US: –7.8% (impact of ongoing tariffs; follows +11.9% in Sept)

- UK: –6.5%

- China: –5.8%

- EU exports: +2.7%

- YTD (Jan–Oct 2025): €1.31T in exports, +1.1% YoY. source: Federal Statistical Office