🇯🇵 Japanese Yen Strengthens as BOJ Eyes Inflation Risks

The Japanese yen gained strength on Friday, trading near ¥145 per U.S. dollar, as Japan’s core inflation surged for the third consecutive month. The latest reading came in at 3.7%, marking the highest level since January 2023 and reinforcing expectations that the Bank of Japan (BOJ) could tighten monetary policy further.

Key Highlights:

- BOJ keeps interest rate at 0.5% but signals openness to further hikes.

- Governor Kazuo Ueda emphasized a data-driven approach.

- Companies continue passing wage increases onto prices, keeping inflation sticky.

- Despite Friday’s rebound, the yen is still down ~1% for the week due to safe-haven flows into the U.S. dollar, amid rising geopolitical tensions between Israel and Iran.

📊 Takeaway: A stronger yen may be on the horizon if inflation remains persistent and the BOJ follows through with rate hikes. However, global risk sentiment and U.S. dollar strength are key counterweights.

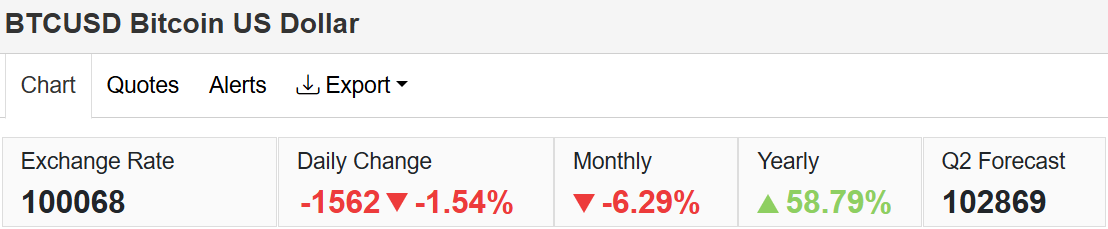

₿ Bitcoin Slips Below $100K Amid Broader Market Uncertainty

On Sunday, June 22, Bitcoin (BTC/USD) fell to $99,449, marking a 2.15% decline from the previous session. Over the past month, Bitcoin has lost 7.32%, reflecting broader risk-off sentiment across markets.

Bitcoin Performance Overview:

- Daily: -2.15%

- 4-week: -7.32%

- 12-month: +57.06%

Price Forecasts (via Trading Economics):

- End of Q2 2025: $102,869

- 12-Month Outlook: $100,787

💡 Outlook: Despite short-term dips, long-term fundamentals and macro trends suggest Bitcoin may stabilize or climb moderately in the coming months. However, global tensions and central bank policies could add continued volatility.

🌍 Final Thoughts

Both traditional currencies like the yen and digital assets like Bitcoin are being shaped by a complex macroeconomic environment, featuring persistent inflation, central bank shifts, and geopolitical unrest.

What to Watch:

- Next BOJ policy meeting and inflation reports.

- U.S. Federal Reserve commentary on rates and inflation.

- Developments in the Middle East and their impact on safe-haven assets.

📰 Stay Informed: Subscribe for weekly macro updates and in-depth analysis on currencies, crypto, and global markets.