🌍 Global Themes

- Trade Tensions Return: The July 9th deadline marks the end of the US tariff pause. Only partial deals (UK, Vietnam, China framework) are in place. Markets are bracing for possible escalations and their impact on global trade flows.

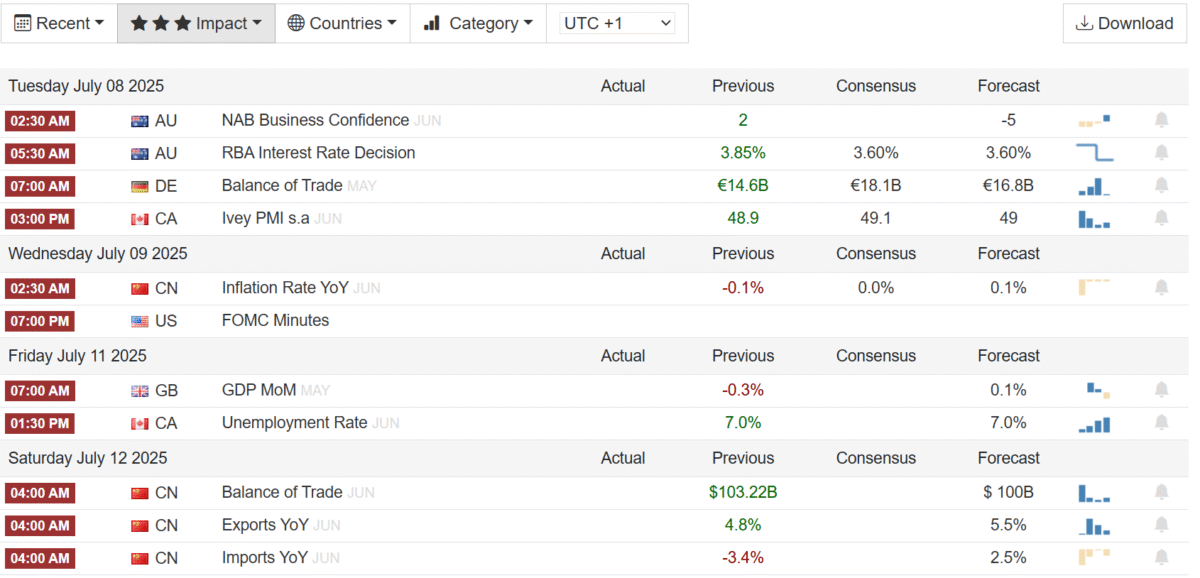

- Fed Watch: Investors await the FOMC minutes and several Fed speeches to gauge the outlook for interest rates. Chair Powell maintains a cautious tone, but markets want more clues on the path for policy in H2.

- Central Bank Decisions: Policy meetings in Australia, South Korea, Malaysia, and New Zealand could signal regional divergence amid slowing global growth and easing inflation.

🇺🇸 United States

- Tariff Deadline: High stakes around the July 9th expiration of tariff relief. Key sectors may face higher import costs unless further agreements are reached.

- Fed & Data:

- FOMC minutes and Fed speeches in focus.

- Data includes: Weekly jobless claims, consumer credit, NFIB Small Business Index, and budget statement.

- Earnings Season Kickoff:

- Watch Delta Air Lines and Conagra Brands earnings on Thursday for early corporate sentiment.

🇨🇦 Canada

- June Jobs Report and Ivey PMI will shape expectations around Bank of Canada’s next move.

🇲🇽 Mexico & 🇧🇷 Brazil

- Mexico: June inflation report will guide Banxico’s next rate decision.

- Brazil: Updates on inflation, retail sales, and business confidence are due.

🇪🇺 Europe

- Germany: Expected second monthly industrial production decline, plus trade, wholesale prices, and final inflation data.

- Eurozone: First dip in retail sales in 5 months.

- UK: Key data on monthly GDP, industrial output, trade balance, and Halifax house prices.

- Italy & France: Final inflation and industrial figures.

- Others: Switzerland (consumer confidence), Turkey (IP), Russia (inflation).

🌏 Asia-Pacific

- China:

- CPI likely flat; PPI deflation to ease (still -3.2% y/y).

- Japan:

- Full slate of data: wages, current account, machine orders, producer prices.

- Australia:

- RBA decision: Third rate cut (25 bps) expected.

- South Korea & Malaysia:

- Monetary policy updates amid growth concerns.

- New Zealand:

- RBNZ to hold at 3.25%.

- Others:

- Inflation data: Vietnam, Thailand, Taiwan.

- Singapore: GDP growth to be closely watched.