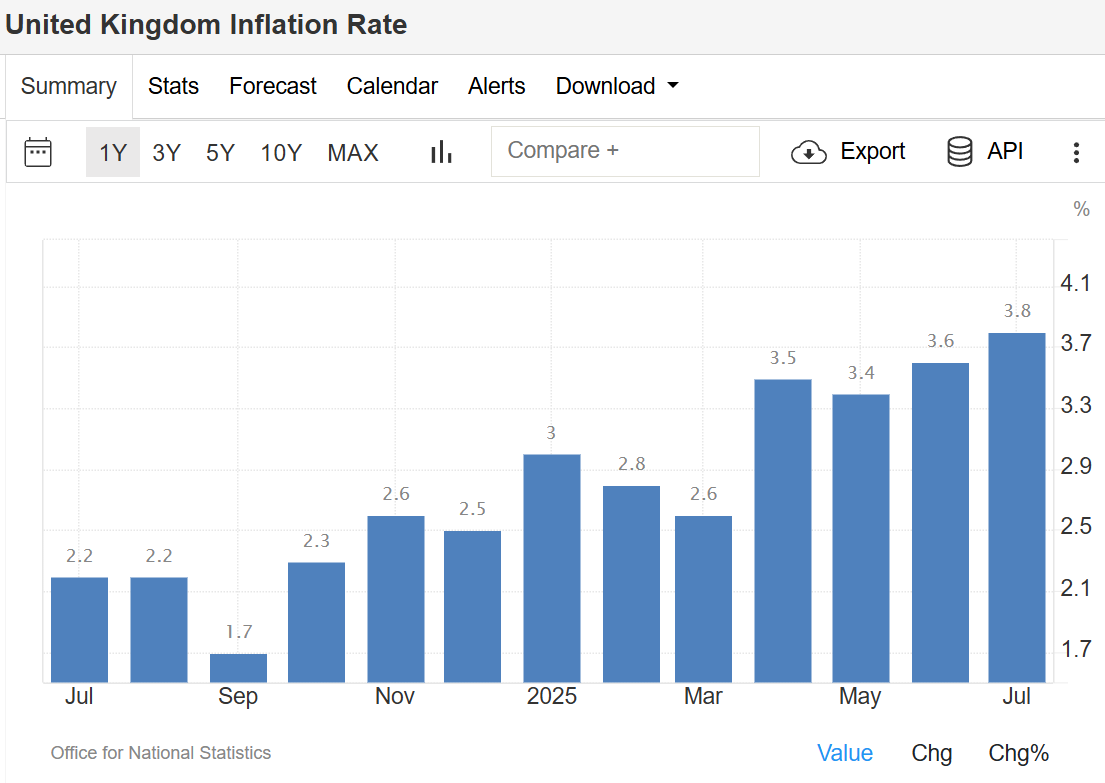

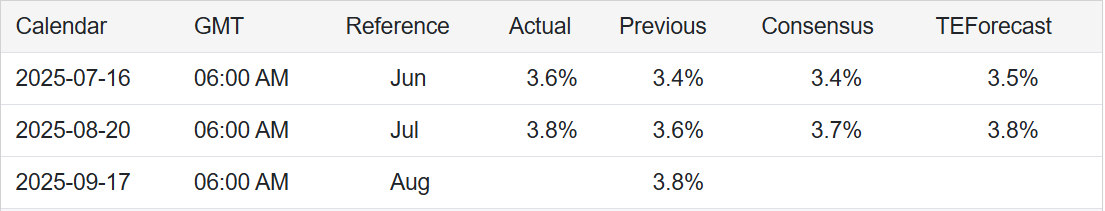

The UK inflation rate rose to 3.8% in July 2025, marking its highest level since January 2024. This was up from 3.6% in June and slightly above market forecasts of 3.7%, according to the Office for National Statistics (ONS).

The main driver of the increase came from the transport sector, where prices climbed 3.2% compared to 1.7% in June. Airfares surged by a sharp 30.2%, largely influenced by the timing of the school summer holidays. Higher motor fuel costs, sea fares, and roadside recovery services also pushed transport inflation higher.

Other notable contributors included restaurants and hotels, where prices rose 3.4% versus 2.6% in June, largely due to more expensive overnight hotel stays. Food and non-alcoholic beverages also accelerated, rising 4.9% compared to 4.5% the previous month.

On the other hand, housing and household services eased slightly, providing some relief. Inflation in this category dropped to 6.2% from 6.7%, reflecting softer growth in owner-occupiers’ housing costs and rents.

On a monthly basis, the Consumer Price Index (CPI) increased 0.1% in July, defying expectations of a 0.1% decline. However, this was slower than June’s 0.3% rise. Core inflation, which excludes energy, food, alcohol, and tobacco, also edged up to 3.8% from 3.7%. source: Office for National Statistics

Contact us if you have any questions or want a Free Consultation.