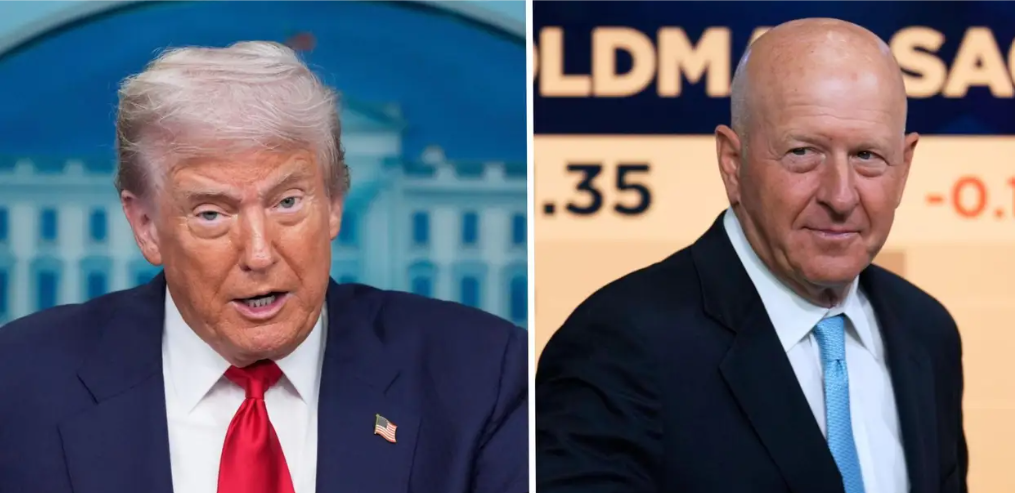

Former President Donald Trump took aim at Goldman Sachs CEO David Solomon on Tuesday, poking fun at his side gig as a DJ while blasting the bank’s past economic forecasts.

“David Solomon and Goldman Sachs refuse to give credit where credit is due,” Trump wrote on Truth Social. “They made a bad prediction a long time ago on both the Market repercussion and the Tariffs themselves, and they were wrong, just like they are wrong about so much else.”

Inflation Numbers Trigger Trump’s Remarks

Trump’s comments followed the release of the July Consumer Price Index (CPI) report — a key measure of inflation. The Bureau of Labor Statistics reported year-over-year inflation at 2.7%, slightly below analyst forecasts of 2.8%.

The Federal Reserve, led by Chair Jerome Powell, has maintained interest rates while evaluating the inflationary impact of tariffs.

Trump took the latest CPI data as validation of his economic stance:

“It has been proven, that even at this late stage, Tariffs have not caused Inflation, or any other problems for America, other than massive amounts of CASH pouring into our Treasury’s coffers,” he said.

Solomon Joins Growing List of CEO Targets

Solomon is the latest high-profile executive in Trump’s firing line. Just last week, the former president called for Intel CEO Lip-Bu Tan’s resignation — before reversing course after meeting with him at the White House on Monday.

With this latest jab, Trump continues his pattern of publicly challenging corporate leaders, often blending policy criticism with personal ridicule.