Stock Market Overview

US stocks saw limited movements on Monday, with major indexes holding near their record highs from last week. The S&P 500, Nasdaq 100, and Dow Jones Industrial Average all traded flat as investors awaited fresh catalysts, particularly from:

- The Federal Reserve’s FOMC meeting minutes

- The Jackson Hole Symposium later this week

Both are expected to offer hints on the Fed’s interest rate outlook.

Trade these data points with Swap Hunter by your side and you are going to have an edge on your Broker, your Bank and your Colleagues.

Download the Swap Hunter Trading System HERE.

Check out our Prices here.

Equities remain supported by growing bets on multiple rate cuts this year, as markets respond to signs of a softening labor market and disinflation pressures.

Key Market Highlights:

- Chipmakers and AI-exposed stocks climbed, with Nvidia (+0.5%) staying near record highs despite recent US export controls.

- Retail stocks were mixed ahead of upcoming quarterly earnings reports.

- Geopolitical backdrop: EU leaders prepared to meet Ukraine’s President Zelensky following US President Trump’s summit with Russian President Putin.

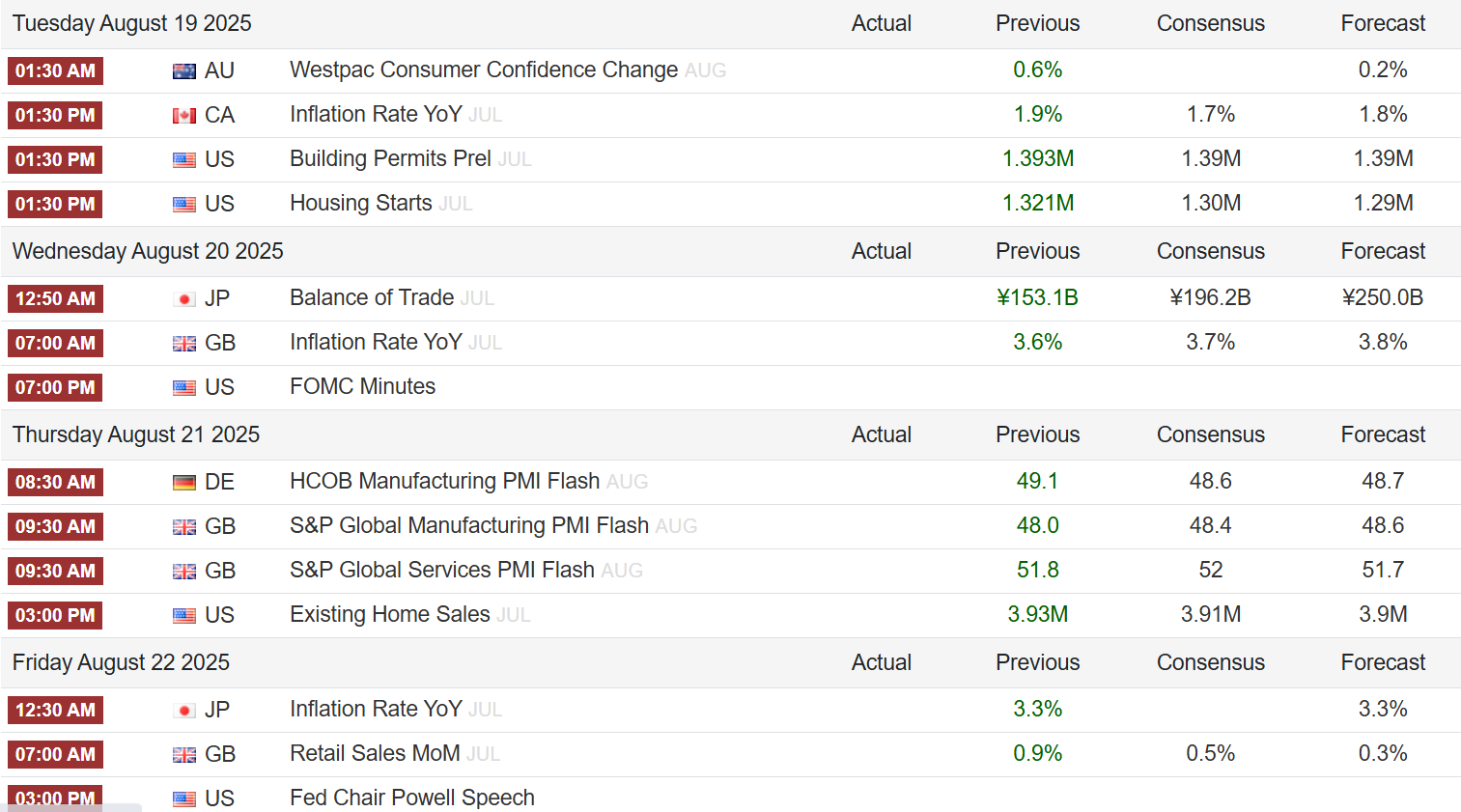

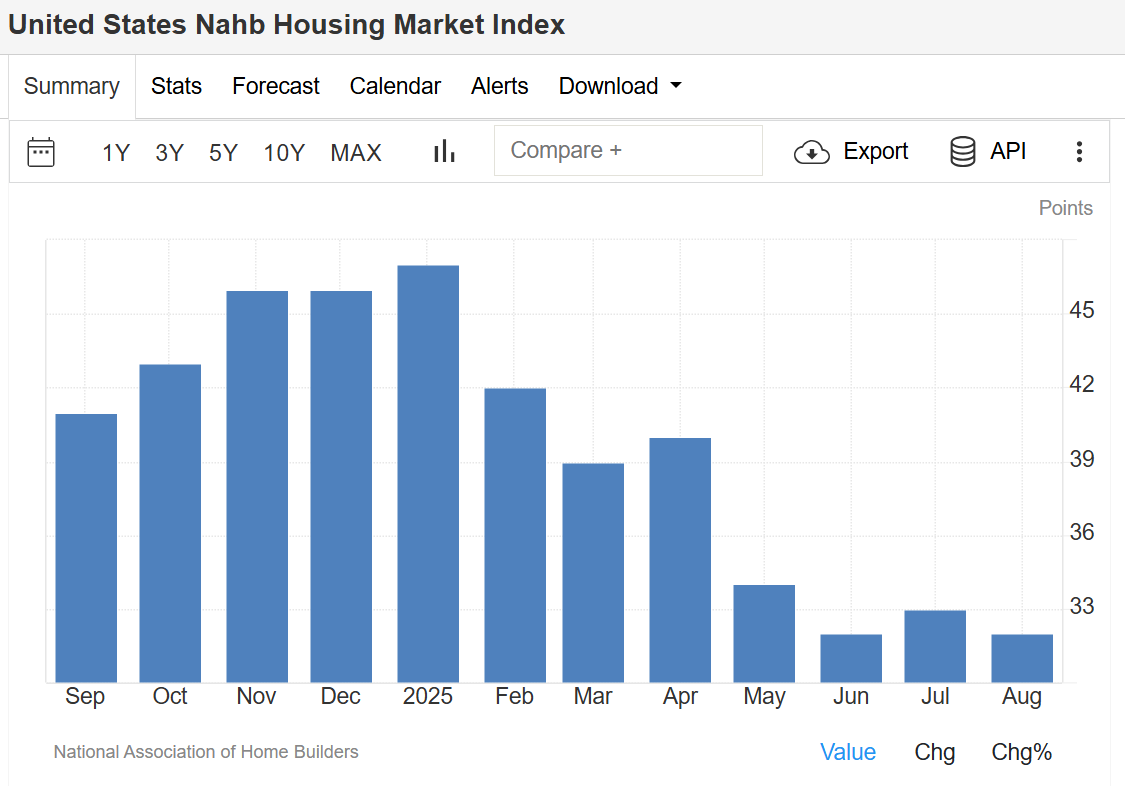

NAHB Housing Market Index – August 2025

The NAHB/Wells Fargo Housing Market Index (HMI) slipped to 32 in August 2025, down from 33 in July and below expectations of 34, signaling persistent challenges in the housing sector.

Breakdown of Housing Data:

- Current sales conditions: fell one point to 35

- Sales expectations (next 6 months): steady at 43

- Buyer traffic: rose two points to 22, still at historically low levels

Builder Incentives & Pricing Trends:

- 37% of builders cut prices in August (down from 38% in July)

- Average price reduction remained at 5% for the tenth straight month

- 66% of builders used sales incentives, the highest post-Covid level, up from 62% in July

This data reflects ongoing affordability concerns, limited buyer demand, and sustained reliance on incentives to stimulate sales. source: National Association of Home Builders

Outlook

- Stock Market: Investors remain cautious but optimistic, balancing AI-driven growth and monetary policy expectations.

- Housing Market: Persistent weakness in builder confidence highlights the impact of affordability challenges, even as incentives expand.

📊 Both markets remain heavily influenced by Federal Reserve policy signals, making this week’s Jackson Hole Symposium a pivotal event for investors and analysts.

Frequently Asked Questions (FAQ)

1. What is the current United States Stock Market Index level in August 2025?

In August 2025, the S&P 500, Nasdaq 100, and Dow Jones remain near record highs after a strong rally earlier in the month. Markets are currently trading flat as investors await signals from the Federal Reserve’s policy outlook.

2. Why are US stocks trading flat despite strong AI and chipmaker performance?

While AI-related stocks like Nvidia continue to perform strongly, overall market movement is subdued due to uncertainty over the Federal Reserve’s interest rate decisions. Investors are waiting for clarity from the Jackson Hole Symposium and FOMC meeting minutes.

3. What does the NAHB Housing Market Index measure?

The NAHB/Wells Fargo Housing Market Index (HMI) measures builder confidence in the housing market, covering current sales, buyer traffic, and future sales expectations. A reading above 50 indicates optimism, while below 50 reflects weakness.

4. Why did the NAHB Housing Market Index fall in August 2025?

The index fell to 32 in August 2025 due to weak buyer demand, affordability challenges, and higher reliance on sales incentives and price cuts by builders.

5. Are US home builders offering more incentives in 2025?

Yes. In August 2025, 66% of builders reported using sales incentives, the highest since the post-Covid period. Price cuts remain common, with an average reduction of 5% per home.

Technical Analysis: S&P 500 – August 2025

The S&P 500 continues to hover near record highs after its sharp rally this summer. Momentum remains strong, but the index is showing signs of consolidation as traders await policy signals from the Federal Reserve.

Key Technical Levels

- Resistance Zone: 5,650 – 5,700 → The index is struggling to break above this level, marking a potential short-term ceiling.

- Support Levels:

- 5,500 (near-term support) – A break below could invite short-term selling.

- 5,350 (major support) – A key level to watch, aligning with the 50-day moving average (50-DMA).

Moving Averages

- 50-Day Moving Average (50-DMA): ~5,350 – Currently acting as strong dynamic support.

- 200-Day Moving Average (200-DMA): ~4,950 – Well below current levels, confirming a longer-term bullish trend.

Momentum Indicators

- RSI (Relative Strength Index): Hovering around 64, just below the overbought threshold (70). This suggests the index is consolidating but not yet in danger of a deep correction.

- MACD (Moving Average Convergence Divergence): Still in positive territory, though momentum is flattening, pointing to a possible range-bound movement in the short term.

Chart Outlook

The S&P 500 remains bullish in the medium to long term, supported by AI-driven growth and easing inflation expectations. However, short-term consolidation is likely until traders get more clarity from Fed policy announcements.

Trading Strategy (Not Financial Advice):

- Bullish bias above 5,500 support

- Watch for a breakout above 5,700 for continuation toward new record highs

- Caution: A sustained break below 5,350 could trigger deeper pullbacks

This is our recommended Broker to Work with although you can use Swap Hunter with any MT4 Financial Derivatives Broker