June 23, 2025 – Global markets are reacting sharply after a surprise escalation in the Middle East, pushing oil prices higher and rattling investor confidence. Meanwhile, fresh data from Japan hints at a modest recovery in the manufacturing sector.

🇺🇸 US Stock Futures Edge Lower After Strikes on Iran

Stock futures dipped early Monday after the United States launched airstrikes on three Iranian nuclear sites over the weekend. The move, which came sooner than expected, has raised fears of retaliation from Tehran and broader regional instability.

President Donald Trump, who had suggested on Friday he’d wait “two weeks” before making a decision, warned Saturday that “there will be either peace, or there will be tragedy for Iran far greater than we have witnessed over the last eight days.”

What’s at Stake:

- Potential Iranian retaliation targeting US assets or personnel

- Disruption of oil shipments through the Strait of Hormuz

- Heightened volatility across energy and equity markets

🛢️ Oil Prices Surge on Supply Fears

WTI crude oil rose over 2% to $75.90 per barrel, reaching its highest level since January 2025. The market is responding to concerns that Iran may restrict oil exports or block the Strait of Hormuz, a crucial artery for about 20% of global crude oil flows.

Iran’s parliament has reportedly voted to close the Strait, though final approval is pending from the country’s Supreme National Security Council and Supreme Leader.

📉 Market Caution Builds

Major US indexes ended last week little changed, as investors braced for worsening geopolitical tensions and growing economic uncertainty. Risk appetite remains subdued as markets await further developments in the Middle East.

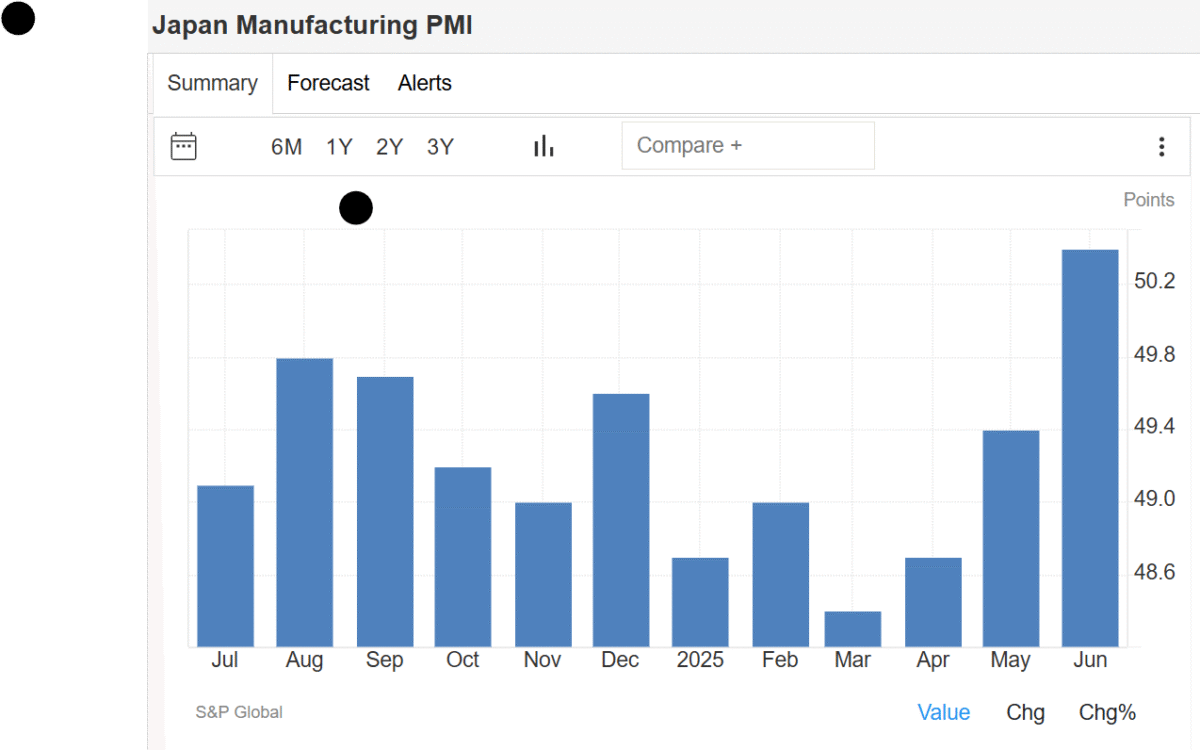

🇯🇵 Japan’s Manufacturing Sector Returns to Growth

On a more positive note, Japan’s Manufacturing PMI from au Jibun Bank rose to 50.4 in June, up from 49.4 in May, marking the first expansion since May 2024. source: S&P Global

Key Highlights:

- Output and inventory levels rose

- Employment edged higher

- Demand remained weak, especially due to new US tariffs

- Supplier delivery times lengthened, signaling supply chain pressure

While input cost inflation held near a 14-month low, output prices remained among the softest seen in four years. Business sentiment was largely unchanged and still below the historical average.

📌 Final Takeaway

The Middle East situation is developing rapidly and will likely remain the dominant market driver in the short term. Investors should keep an eye on:

- Iran’s next move

- Oil market dynamics

- Safe-haven assets like gold and the US dollar

Meanwhile, Japan’s modest manufacturing recovery offers a sliver of optimism amid global turbulence.