WTI crude oil, gold prices, and the US dollar index all moved significantly on Thursday as geopolitical developments, Fed policy signals, and economic data shaped market sentiment.

Crude Oil Prices Rise Ahead of US–Iran Talks and OPEC+ Meeting

WTI crude oil futures climbed above $65 per barrel on Thursday, building on recent gains and recovering from earlier losses in the week. The rally comes as investors await high-stakes talks between the US and Iran scheduled for next week. These discussions aim to reduce tensions in the Middle East and limit Tehran’s nuclear ambitions.

The move follows President Trump’s reaffirmation of the maximum pressure campaign, including restrictions on Iranian oil exports. However, he also hinted at possible enforcement leniency to support Iran’s reconstruction, suggesting China may continue importing Iranian crude.

In a sign of strong demand, US crude inventories dropped by 5.8 million barrels, reaching an 11-year seasonal low. Cushing stockpiles also fell to the lowest since February.

Markets are now turning their focus to the upcoming OPEC+ meeting on July 6, where the group will set its production policy for August. Russia may support a supply increase if conditions warrant it.

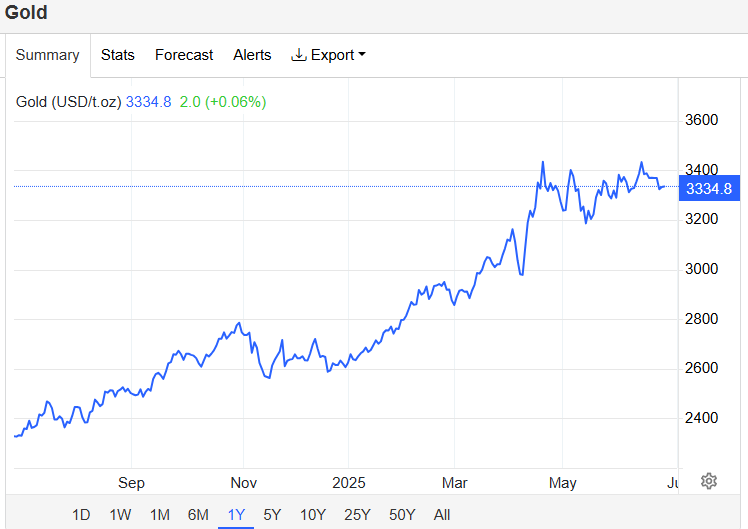

Gold Prices Edge Higher on Weaker Dollar, Geopolitical Relief

Gold prices rose toward $3,340 per ounce, extending gains from the previous session. The weaker US dollar and falling Treasury yields provided support, while easing geopolitical tensions added a further boost.

Next week’s US–Iran talks have sparked cautious optimism in markets. While the ceasefire between Iran and Israel is holding, concerns about its durability remain.

Meanwhile, Fed Chair Jerome Powell, in his second day of testimony, maintained a balanced stance—acknowledging inflation risks from tariffs but holding off on immediate rate cuts. Nonetheless, weak consumer confidence in June raised fresh concerns about the labor market and trade uncertainty, potentially strengthening the case for future easing.

Markets are now closely watching key data, including Thursday’s final Q1 GDP reading and initial jobless claims, followed by PCE price data on Friday.

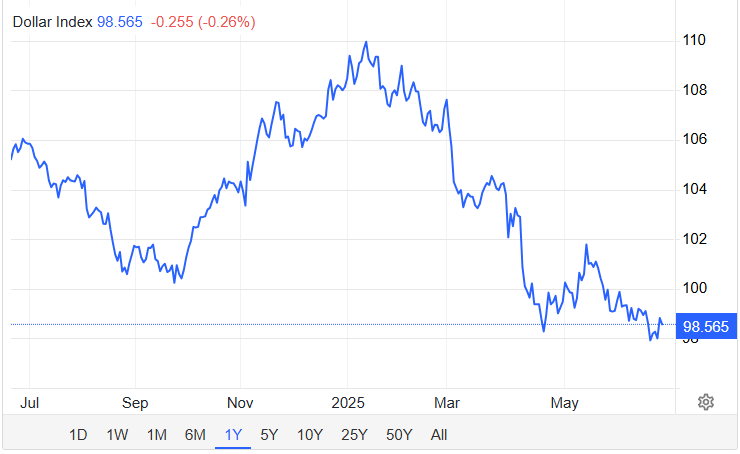

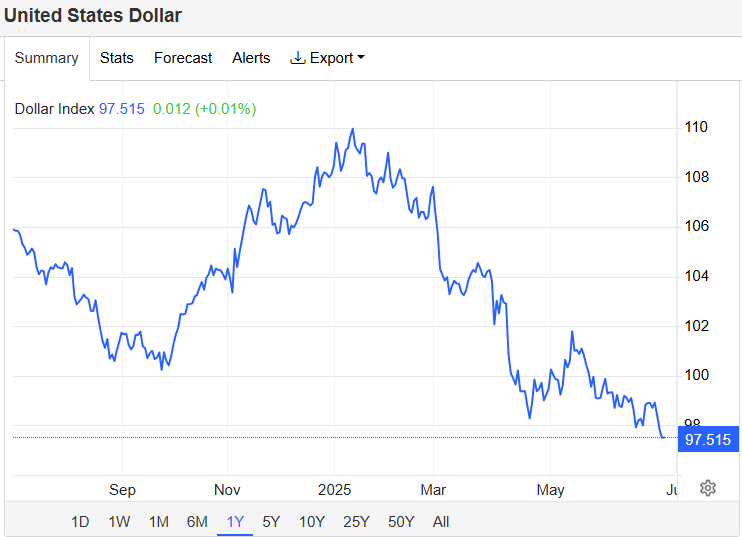

US Dollar Slides to Three-Year Low Amid Rate Cut Expectations

The US dollar index fell to around 97.5, marking its lowest level in over three years. The decline reflects a mix of easing geopolitical tensions, growing fiscal worries, and expectations of Federal Reserve rate cuts.

With the ceasefire between Iran and Israel seemingly stable and US–Iran negotiations on the horizon, risk sentiment improved. On the policy front, Chair Powell reiterated a cautious stance, stating that while tariffs may drive inflation, the Fed would likely continue easing absent those pressures.

Traders are now pricing in over 60 basis points of rate cuts by year-end, with the next move anticipated in September. Attention is also turning to US trade negotiations ahead of President Trump’s July 9 deadline, and efforts in Congress to finalize a tax and spending package around the same period.

Looking Ahead

Markets are poised for more volatility as geopolitical, economic, and policy developments continue to unfold. Investors should watch closely for:

- US–Iran nuclear talks next week

- July 6 OPEC+ meeting outcomes

- Upcoming US economic data (GDP, jobless claims, PCE)

- Fed policy signals amid global trade uncertainty

Stay tuned for further updates as these stories evolve.

Fill out the registration form below to receive a FREE consultation from Swap Hunter

Open your Trading Account with MEX Atlantic, part of the MultiBank Group