European Stocks Climb as Ceasefire Holds, Fed Dovish Tone Lifts Sentiment

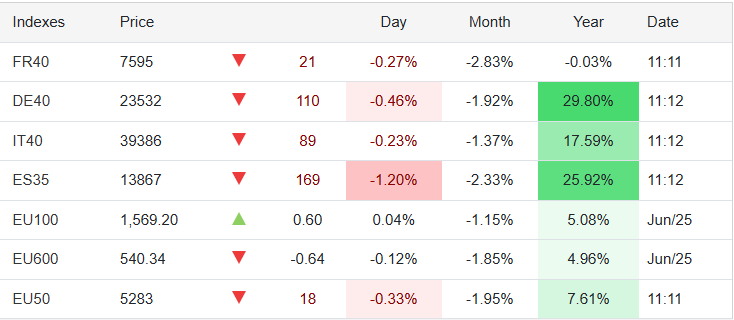

Markets held onto their upward momentum Wednesday, with the STOXX 50 and STOXX 600 indices both rising 0.3%, extending gains of over 1% from the previous session. Investors were buoyed by easing geopolitical tensions and growing hopes for a Federal Reserve rate cut later this year.

🌍 Geopolitical Calm Brings Relief

The recent ceasefire between Israel and Iran appears to be holding, providing a much-needed breather for global markets. The truce—brokered by the United States—has helped temper fears of a broader conflict in the Middle East, a key concern for global investors in recent weeks.

📉 Fed Signals Potential Rate Cuts

Further optimism was driven by Federal Reserve Chair Jerome Powell, who gave testimony before the U.S. Congress on Tuesday. His remarks were widely interpreted as dovish, increasing expectations that the Fed could cut interest rates later this year, providing additional support to financial markets.

🔍 Focus Shifts to NATO Summit

Investors are now watching the NATO summit in the Netherlands, where discussions around defense spending and geopolitical stability are taking center stage. Any shifts in policy or alliances could have broader market implications.

Winners on the European Stock Front

Several major companies posted strong gains amid the upbeat mood:

- Ferrari (RACE): +3.6%

- Stellantis (STLA): +3.7%

- ASML Holding (ASML): +2.3%

- Philips (PHG): +2.0%

- Rheinmetall (RHM): +1.5%

These moves reflect renewed investor confidence across a range of sectors, from luxury autos to defense and technology.

Crude Oil Bounces Back After Heavy Selloff

WTI crude oil prices rebounded above $65 per barrel on Wednesday, recovering some ground after a 13% plunge over the prior two sessions—the steepest two-day fall since 2022.

🔥 What’s Driving Oil?

- The ceasefire in the Middle East is reducing supply disruption fears.

- President Trump signaled support for China—Iran’s top buyer—to continue importing Iranian oil, potentially reshaping the U.S. sanctions landscape.

- Despite this, a preliminary U.S. intelligence report warned that American strikes on Iranian nuclear facilities only delayed the program by a few months, keeping geopolitical risk on the table.

📉 Supply Tightens

Fresh industry data revealed a 4.28 million barrel drop in U.S. crude inventories last week, smashing forecasts for just a 0.6 million barrel draw. This marks the fourth consecutive weekly decline and signals tightening supply conditions.

🧠 Final Thoughts

Markets are finding their footing amid complex global dynamics. While the ceasefire and dovish Fed tone provide near-term relief, investors remain cautious as geopolitical risks and inflation pressures continue to shape the global economic outlook.

Register With Swap Hunter to Get your FREE Consultation

Get Your MultiBank, MEX Atlantic Trading Account today