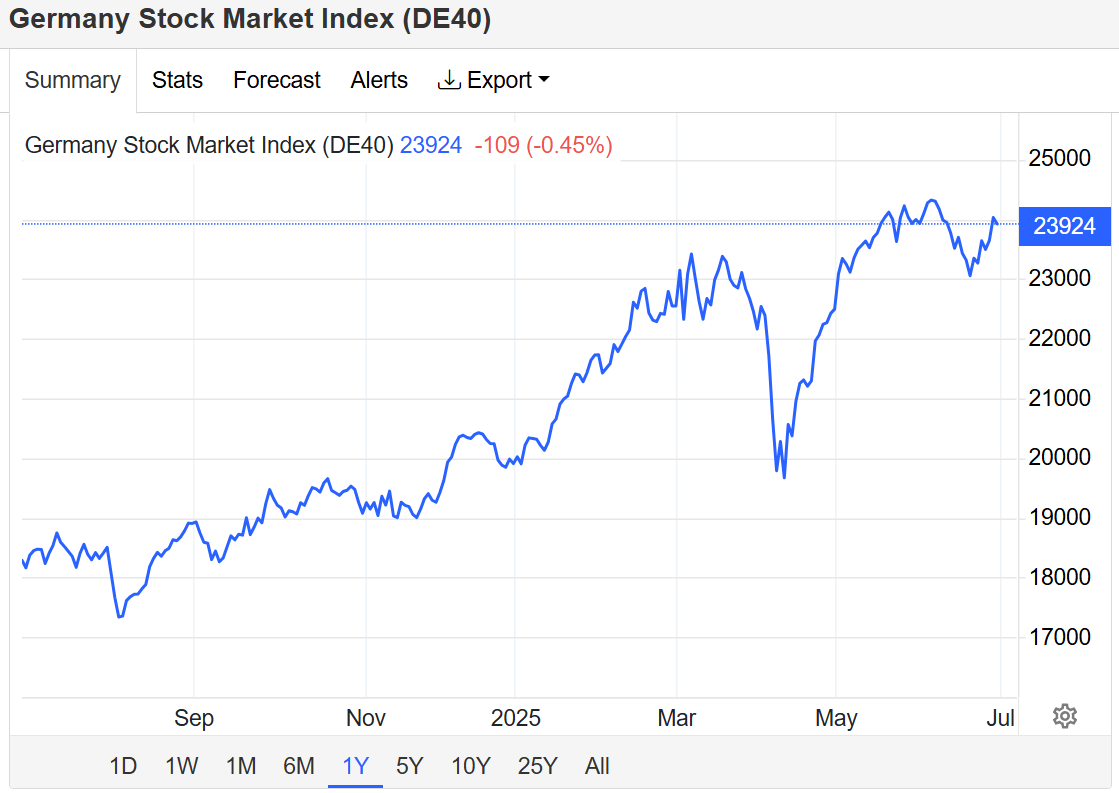

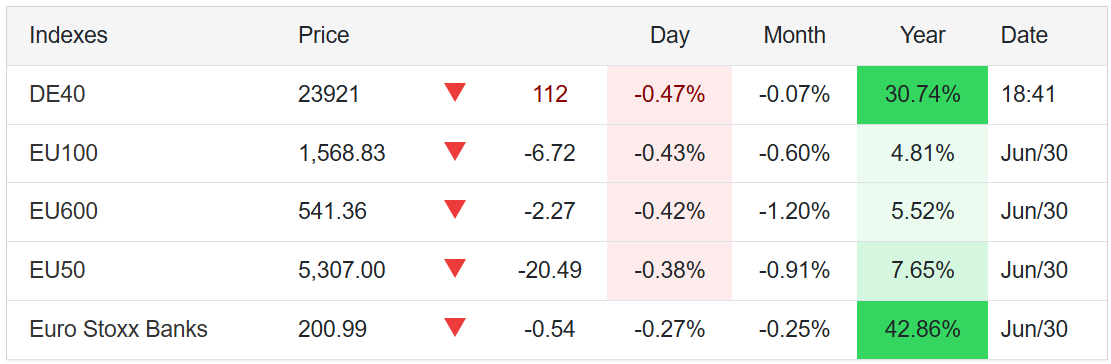

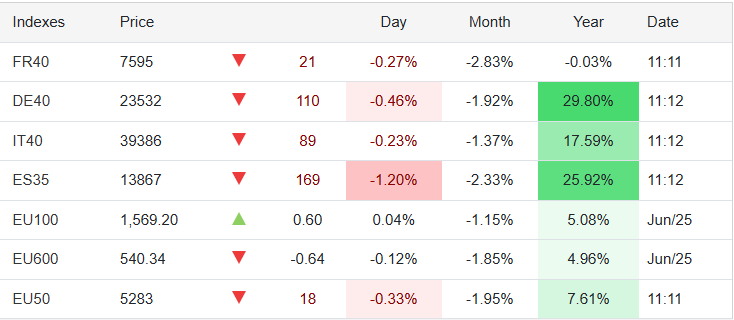

📊 Germany Stock Market Index (DE40) Falls Amid Economic Uncertainty

The Germany Stock Market Index (DE40)—which tracks the performance of 40 top German blue-chip stocks—closed down 0.5% at 23,910 on Monday, breaking a two-day winning streak. The decline comes amid mixed domestic economic data and renewed trade concerns.

🇩🇪 Key Economic Indicators in Germany

✅ Inflation Cools in June

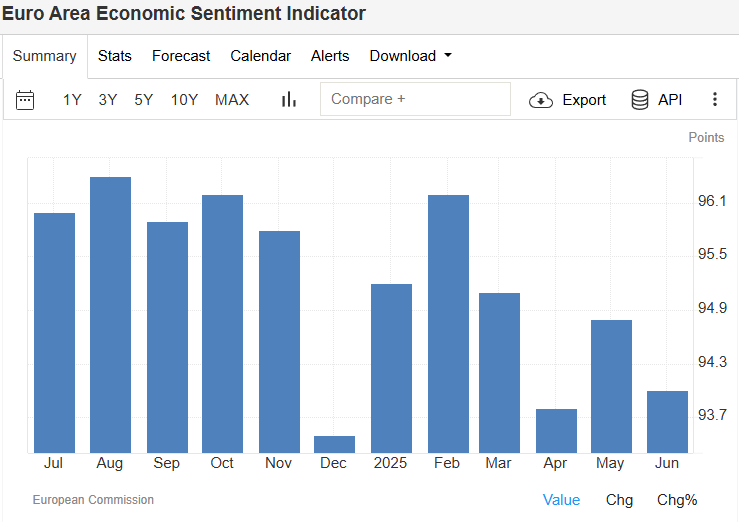

German inflation surprised markets by dropping to 2.0% year-on-year in June, down from 2.1% in May and below the 2.2% forecast. This signals easing price pressure, potentially giving the European Central Bank (ECB) more flexibility on interest rates.

❌ Retail Sales Point to Weak Consumer Demand

Germany’s retail sales fell 1.6% in May, following a 0.6% drop in April. This back-to-back decline underlines sluggish domestic consumption, a key factor limiting broader economic recovery in Europe’s largest economy.

🌐 Trade Tensions Add Market Pressure

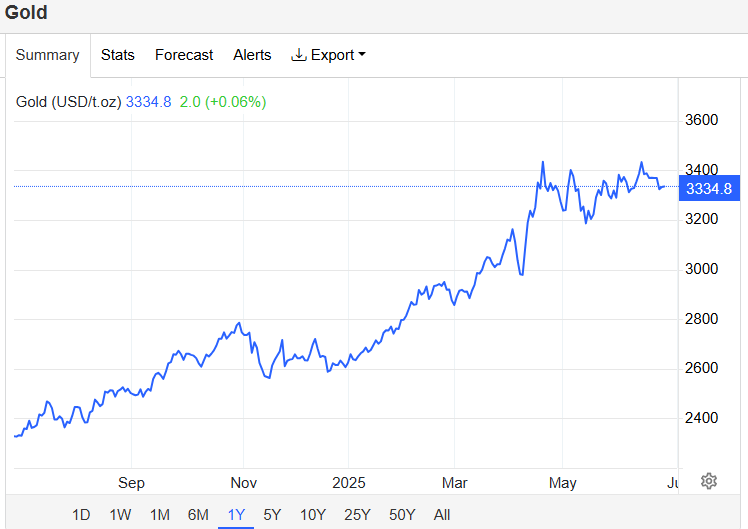

Global trade uncertainty continues to weigh on the German stock market. U.S. President Trump confirmed that trade negotiations are ongoing but won’t extend the current 90-day tariff pause beyond July 9. This raises risks for Germany’s export-heavy economy, especially sectors like automotive and chemicals.

🔻 Biggest DAX Losers: Symrise and Bayer

- Symrise AG led the market declines with a sharp 7% drop, likely due to sector sentiment or earnings-related concerns.

- Bayer AG tumbled 5.4% after the U.S. Supreme Court requested the government’s opinion on Monsanto weedkiller litigation, reigniting legal uncertainty for the pharma and agrochemical giant.

📆 DE40 Monthly Performance

Despite occasional gains, the DAX (DE40) ended June with a modest 0.4% loss, reflecting ongoing macroeconomic headwinds and market caution.

📌 What to Watch Next

- July 9 Trade Deadline: Markets will closely monitor whether new tariffs are imposed.

- Upcoming ECB Decisions: Slower inflation may influence monetary policy.

- Consumer Confidence & Earnings Reports: Key indicators for Q3 market direction.