U.S. Nonfarm Payrolls Rise 147K in June, Topping Expectations

The U.S. economy added 147,000 jobs in June 2025, according to the Bureau of Labor Statistics, surpassing forecasts of 110,000 and marking a slight uptick from an upwardly revised 144,000 in May. The latest reading aligns with the 12-month average of 146,000, continuing to demonstrate labor market resilience despite economic headwinds.

Government jobs made up nearly half the gains, adding 73,000 positions, primarily in state education (+40K) and local education (+23K). Federal government employment, however, declined by 7,000, continuing a downtrend since its January peak.

Healthcare remained a key driver, adding 39,000 jobs, with hospitals (+16K) and nursing and residential care facilities (+14K) leading the way. Social assistance roles also grew by 19,000.

⚠️ Analysts caution that a hiring slowdown could emerge as uncertainty surrounding tariffs, trade, and immigration policies persists.

ISM Services PMI Rebounds to 50.8

The ISM Services PMI climbed to 50.8 in June, up from 49.9 in May, exceeding expectations of 50.5. This signals a return to modest growth in the services sector after a brief contraction.

Key highlights:

- Business activity rose to 54.2 (vs 50.0)

- New orders rebounded to 51.3 (vs 46.4)

- Inventories and export orders also improved

- Price pressures eased slightly to 67.5 from 68.7

However, concerns about tariffs and slowing supplier delivery performance (50.3 vs 52.5) remain prevalent. Middle East tensions were noted for the first time, though no direct supply disruptions were reported.

U.S. Trade Deficit Widens Sharply

The U.S. trade deficit widened to $71.5 billion in May, up from $60.3 billion in April, as exports dropped 4% to $279 billion, led by declines in nonmonetary gold, natural gas, and finished metal shapes. Imports dipped just 0.1% to $350.5 billion.

Major trade gap increases:

- EU: -$22.5B (from -$17.9B)

- Mexico: -$17.1B (from -$13.5B)

- Canada and Vietnam: modest increases

- China: narrowed to -$14B (from -$19.7B)

source: Bureau of Economic Analysis (BEA)

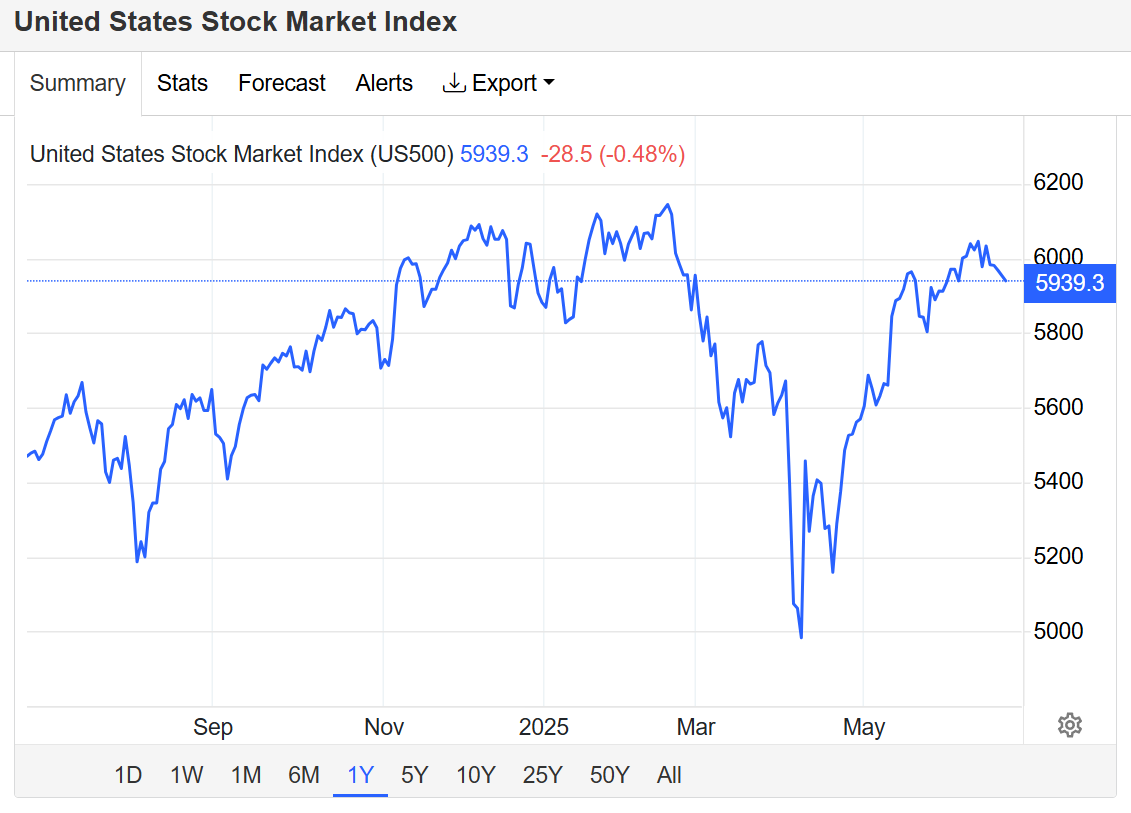

Markets Rally on Strong Jobs Data and AI Optimism

All three major U.S. indices climbed over 0.8% on Thursday, with the S&P 500 and Nasdaq 100 closing at record highs. The strong June payroll report and an unexpected drop in the unemployment rate to 4.1% fueled investor confidence.

Big movers:

- Nvidia: +1.3%

- Synopsys: +4.2% on lifted U.S. export restrictions to China

- Cadence Design & Synopsys: ~+5% on AI strength

- Datadog: +10% on S&P 500 inclusion

Optimism also stemmed from progress in the U.S.-Vietnam trade deal and the House nearing final approval of President Trump’s $3.4 trillion tax-and-spending bill.

Key Takeaways

- Labor market continues to show strength but faces downside risks.

- Services sector rebounds, though growth remains modest.

- Trade imbalance widens on export slump.

- Stock market surges on tech gains and policy optimism.

Conclusion

The June 2025 economic indicators paint a mixed yet cautiously optimistic picture. While the labor market and services sector show resilience, trade imbalances and policy uncertainty loom large. Investors appear encouraged by tech sector momentum and fiscal stimulus prospects, but volatility could reemerge as global tensions and trade debates evolve.