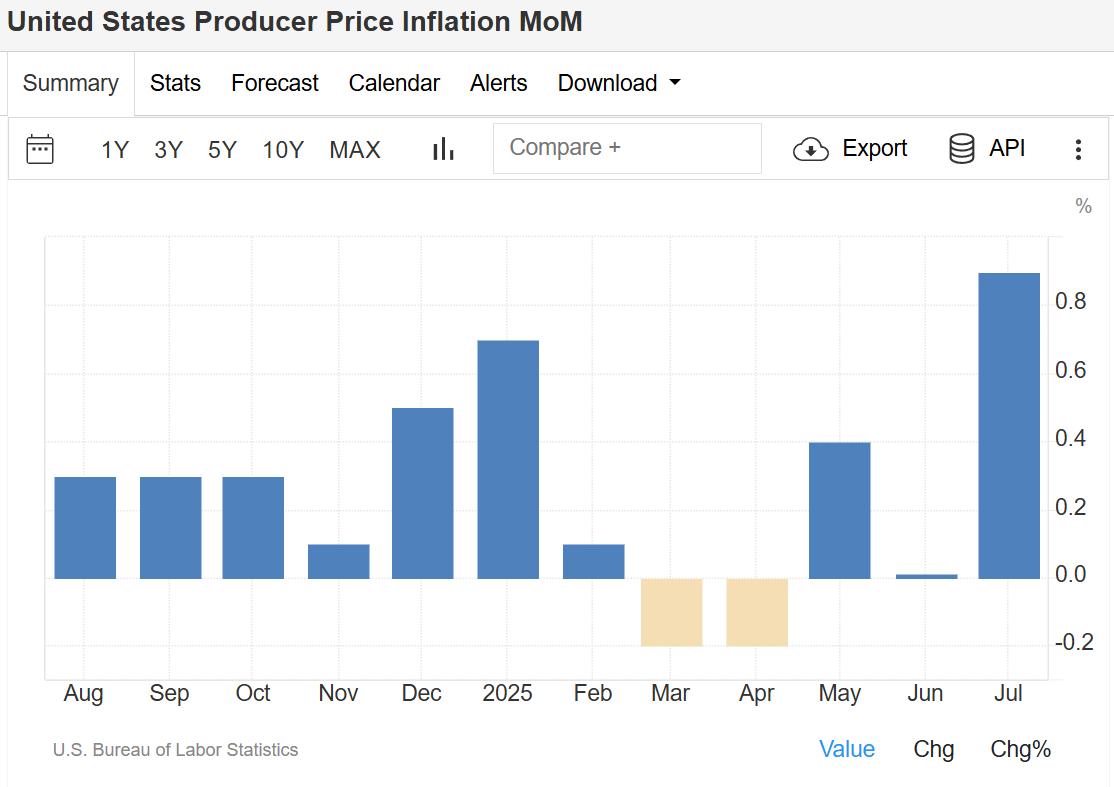

The US Producer Price Index (PPI) for July 2025 surged 0.9% month-over-month, marking the sharpest increase since June 2022. This rebound from June’s flat reading easily beat market forecasts of a 0.2% rise, highlighting stronger-than-expected inflation pressures.

Services costs led the gain, climbing 1.1% in July. The biggest driver was a 3.8% jump in margins for machinery and equipment wholesaling, with additional increases in portfolio management, securities brokerage, investment advisory services, traveler accommodations, automobile retailing, and truck freight transportation.

Goods prices also rose 0.7%, fueled by a staggering 38.9% surge in fresh and dry vegetable prices. Other contributors included higher costs for meats, diesel fuel, jet fuel, nonferrous scrap, and eggs, partially offset by a 1.8% drop in gasoline.

The core Producer Price Index—excluding food and energy—also climbed 0.9%, far above the expected 0.2%.

On a yearly basis, headline producer inflation accelerated to 3.3%, the highest in five months, while core PPI jumped to 3.7% from 2.6% in June. Both figures came in well above analyst expectations, potentially complicating the Federal Reserve’s path toward interest rate cuts later this year. Source: U.S. Bureau of Labor Statistics

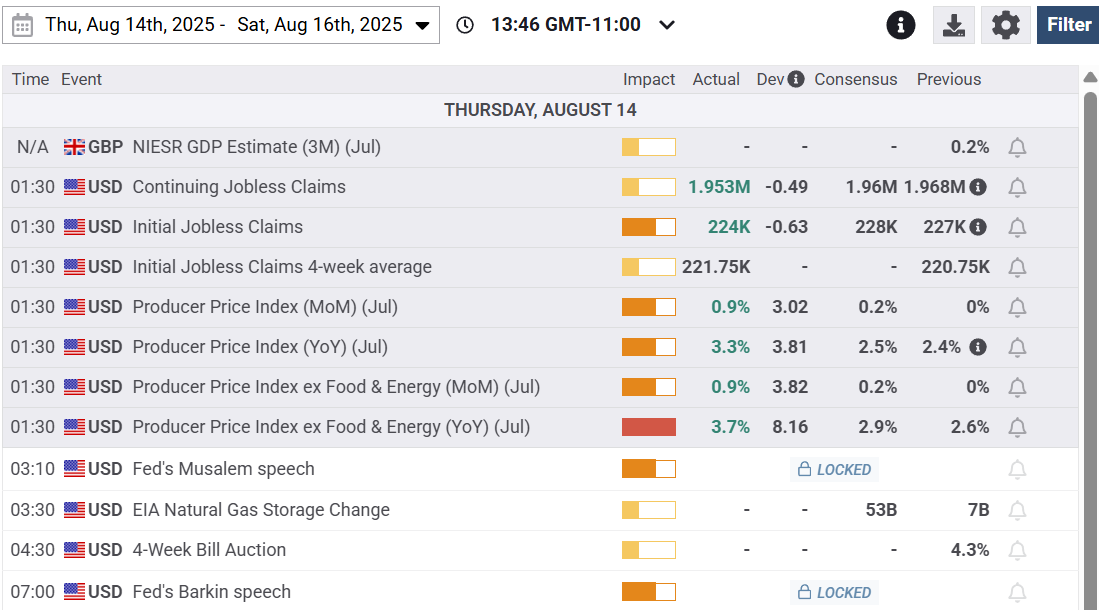

Economic Calendar Displaying todays PPI data and Jobs data.

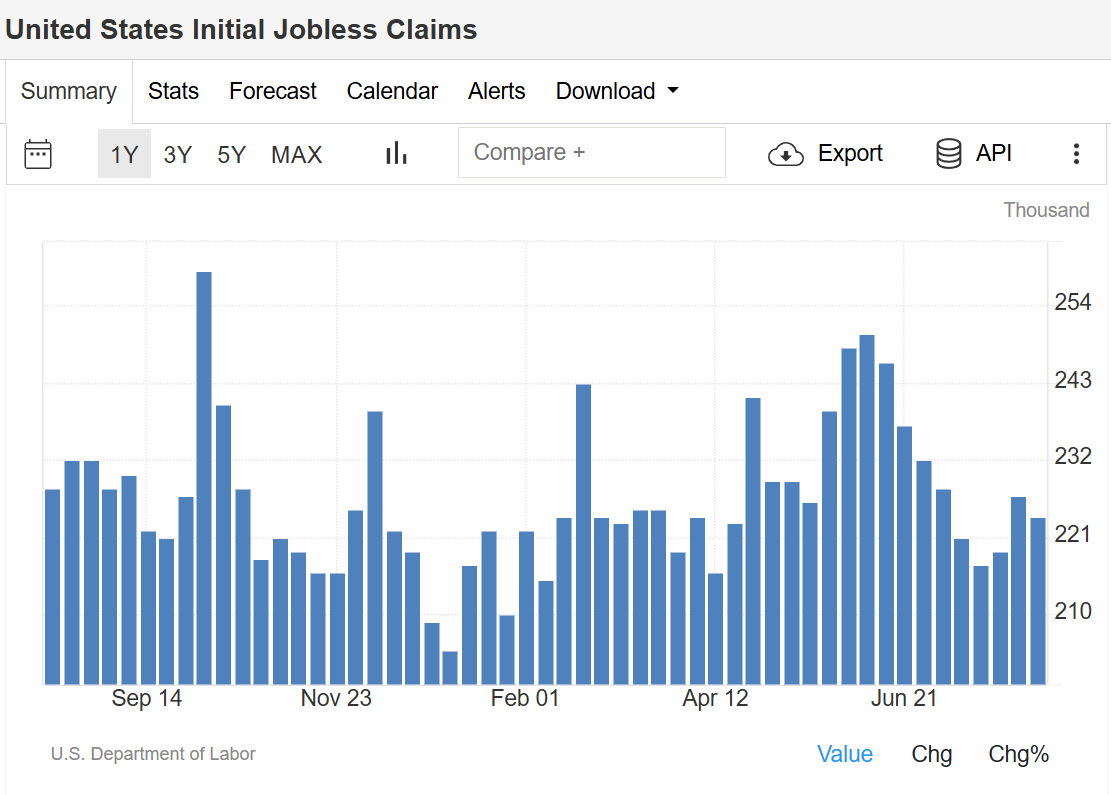

📉 US Jobless Claims Fall More Than Expected

U.S. initial jobless claims slipped to 224,000 in early July 2025, down 3,000 from the prior week and below forecasts of 228,000. Continued claims eased by 15,000 to 1.953 million, retreating from a three-year high.

The labor market remains solid despite signs of slowing, with hiring cooling and payroll figures recently revised lower. Federal government employee claims—closely watched after DOGE layoffs—fell by 71 to 637. source: U.S. Department of Labor