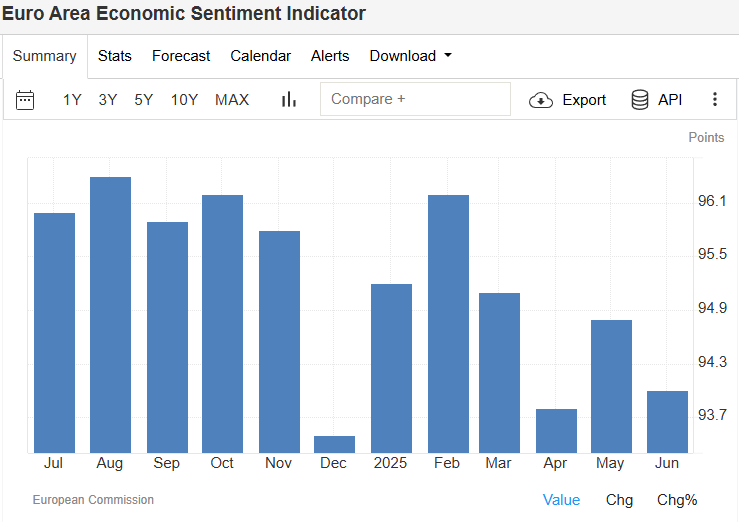

Euro Area Economic Sentiment Indicator Falls to 94 in June 2025

The Economic Sentiment Indicator (ESI) for the Euro Area dropped to 94 in June 2025, down from 94.8 in May and well below market expectations of 95.1, according to the latest data from the European Commission.

📉 Key Drivers of the Decline

The drop in sentiment was largely driven by the industrial sector, where confidence slipped to -12 from -10.4 in the previous month. The decline reflects:

- Lower order book assessments

- Higher stocks of finished products

- Weaker production expectations

Additional declines were observed in:

- Retail confidence: -7.5 (vs -7.2 in May)

- Consumer confidence: -15.3 (vs -15.1)

📈 Sectors Showing Improvement

Despite the overall downturn, two sectors posted gains:

- Services: Confidence improved to 2.9 (from 1.8)

- Construction: Rebounded slightly to -2.8 (from -3.5)

🌍 Country-Level Highlights

Biggest Declines:

- France: 89.6 (down from 93)

- Spain: 102 (down from 103.4)

- Germany: 90.7 (down from 91.5)

Stable or Improving:

- Poland: 101.4 (up from 100.4)

- Italy: 98.9 (vs 98.7)

- Netherlands: 97.1 (vs 96.9)

🔎 What It Means for the Eurozone

The data suggest ongoing economic weakness across the Eurozone, particularly in manufacturing and retail sectors. While services and construction offer some support, the overall picture points to fragile business and consumer confidence as the region navigates 2025.

This divergence between countries—particularly the downturn in France and Germany—highlights uneven recovery dynamics within the EU bloc.

source: European Commission

Stay tuned for more updates on EU economic indicators and what they mean for markets and policy.