Silver (XAG/USD) rebounds from a two-week low as the US Dollar weakens and traders await the Fed’s July meeting minutes. Will XAG/USD break higher from its symmetrical triangle pattern?

Silver Price Rebound Amid Dollar Weakness

Silver (XAG/USD) staged a sharp recovery on Wednesday, snapping a four-day losing streak after dropping to its lowest level since August 4. The metal found support as the US Dollar retreated, pressured by political headlines after President Trump called for the resignation of Federal Reserve Governor Lisa Cook.

At the time of writing, XAG/USD trades around $37.80, up nearly 1% on the day, after rebounding from an intraday low of $36.96. The move comes as markets turn cautious ahead of the release of the FOMC July meeting minutes at 18:00 GMT, which may shape expectations for the Fed’s inflation outlook and rate trajectory.

Silver Technical Analysis: Triangle Pattern in Play

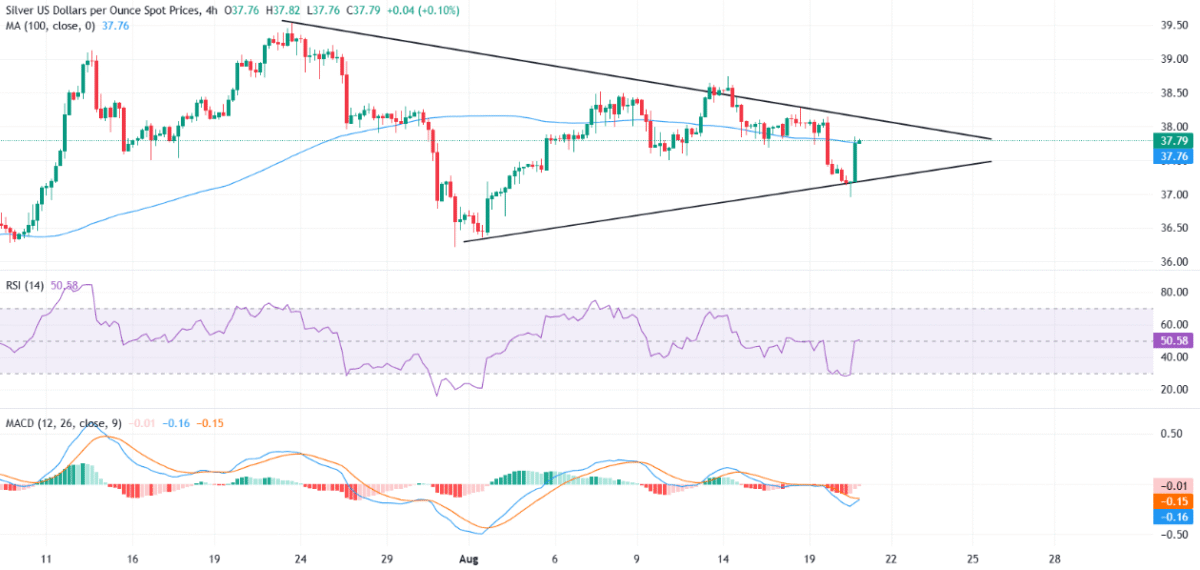

On the 4-hour chart, Silver is trading within a symmetrical triangle formation, consolidating recent price action. The rebound from the lower boundary near $37.00 suggests strong buying interest at this support zone.

- Immediate resistance sits at the 100-period Simple Moving Average (SMA) near $37.76.

- A sustained breakout above this level could open the door toward $38.20, the upper boundary of the triangle and a key psychological mark.

- Further upside targets include $38.74 (August 14 swing high) and $39.53, a multi-year peak.

On the downside:

- A failure to clear the 100-SMA may keep Silver confined within the triangle.

- A break below $37.00 support could trigger bearish momentum, exposing $36.50 and $35.90 as the next demand levels.

Momentum Indicators Signal Potential Shift

- RSI: After briefly dipping into oversold territory, the Relative Strength Index has rebounded toward the midline, signaling improving intraday strength.

- MACD: The histogram is narrowing, with the MACD line nearing a bullish crossover above the signal line—an early sign that bearish pressure is fading.

These technical signals suggest a potential bullish reversal is underway if Silver can secure a breakout above resistance.

Silver Price Forecast: Outlook

Silver’s near-term outlook hinges on the Fed’s July meeting minutes and the US Dollar’s reaction. A dovish tilt in the Fed’s inflation or rate outlook could weaken the Dollar further, providing support for Silver prices. Conversely, a hawkish tone may cap gains and keep XAG/USD trapped within its current range.

In summary:

- Above $38.20 → bullish momentum may accelerate toward $38.74 and $39.53.

- Below $37.00 → sellers could regain control, targeting $36.50 and $35.90.