What Many Traders Overlook

New to trading? Feeling overwhelmed by how much there is to learn in order to be consistently profitable? Which broker do I invest with? Do I have a Strategy? Do I use Technical or Fundamental Analysis?

Overnight Fees, Spreads, Commissions, Tick Value, Margin Allocation. There are many things to learn about and be aware of in regards to the Cost of Trade before you enter a position.

If you don't consider all of these factors or fees, you will not last longer than 3-6 months in the market.

Overnight Fees also known as "Swaps" are definitely the most overlooked by newbies.

It is costly to hold trades for longer periods of time due to the Swaps. This common oversight in the Forex market can make it difficult for traders to make informed decisions and ultimately leads to losses. Traders must be aware of the costs of trading, this is one reason why we developed our software and service. To teach them about Cost of Trade and to provide the solution. Also so traders can use our Carry Trading Systems to lower risks and to generate returns in the form of Swaps.

Get Paid to Trade, Be a Swap Hunter!

Benefits at a glance

Monthly Subscription

Installation, 5 FREE training sessions, ongoing technical support.

Lifetime License

Installation, 15 FREE training sessions, ongoing technical support.

Designed for

Long-Term Investors

can benefit from earning swaps by holding positions for extended periods and staying hedged to reduce risks. By using 'Swap Hunter', they can analyze the swaps offered by various brokers and choose the one that provides the best returns. Additionally, they can use the tool to monitor their positions and ensure that they remain hedged to avoid losses. Ultimately, earning swaps can be a valuable source of passive income for long-term investors in the Forex market.

Novice Traders

can minimize risks and make informed decisions. Swap Hunter analyses currency pairs to find those that offer the highest overnight swaps. By identifying these currency pairs, 'Swap Hunter' gives traders an edge over the market. With the right skills, knowledge, and experience, traders can make informed decisions and achieve financial freedom. With the help of this tool, novice traders can gain confidence in their trades and reduce the risks associated with Forex trading.

Forex scalpers and day traders

can use 'Swap Hunter' to analyze currency pairs, traders can identify those with the best overnight swaps, which can help them maximize profits in the short term while minimizing the cost of holding trades. Additionally, 'Swap Hunter' can monitor positions to ensure that they remain hedged and avoid losses. With 'Swap Hunter', Forex scalpers and day traders can gain an edge over the market and brokers and achieve financial freedom in the short term.

PAMM/MAM managers

have a responsibility to secure their clients' funds and generate steady mid- and long-term profits. By using 'Swap Hunter' to analyze currency pairs, managers can find those with the best overnight swaps, which can help maximize profits while minimizing the cost of holding trades. Additionally, they can monitor positions to ensure that they remain hedged and avoid losses, reducing the risk of losing clients' funds.

Ways to use Carry Trading to generate profits

Investment Strategy "Hold the hedge"

Strategy suitable for Investing with focus on capital preservation. Build up profits steady and beat inflation by collecting the overnight swaps and the weekly triple rollover. Lower the risks of trading in the financial markets significantly through hedging.

Investment Strategy "Release the Hedge"

Strategy for experienced traders, who are looking for higher profits. Generate quicker and higher returns but with higher risk. Profit from accumulated Swaps and banking profits on the winning side of the hedge. Then recovering the losses from losing side of the hedge.

New option: Swap Hunter PAMM

We have created a PAMM investment account for Investors without previous trading experience. The Swap Hunter PAMM is utilising all the Carry Trading strategies: Hold the Hedge, release the hedge and tripple rollover, banking Profits and let the P&L float.

Get your Edge over the Market

Testimonials

Senior Manager, PAMM Investor

"I was looking for a good investment opportunity in a low interest market. With no experience in Forex or trading. I prefer slow and steady returns, which Swap Hunter provide. Protecting my equity against inflation is my priority and gain a little extra interest."

Professional Trader

"Carry trading is not new, but with Swap Hunter it is easier than ever to facilitate this strategy. It is used by institutional level investors and the banks. I've not seen a tool like this for MT4 and it is very powerful, if you implement it in your investment portfolio"

Joao Monteiro

CEO 4XC.com

"Partnering up with Swap Hunter has proven to be extremely successful. As we see traders looking for alternative trading techniques and styles, Swap Hunter provide some of the best tools for this. We can give our traders swap correlation, carry trading indicators and much more. "

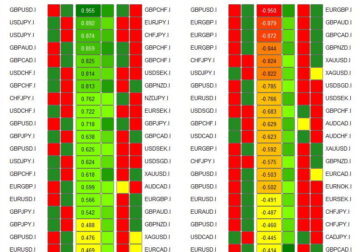

Strong combination of MT4 indicators

Included in the Swap Hunter MetaTrader 4 package

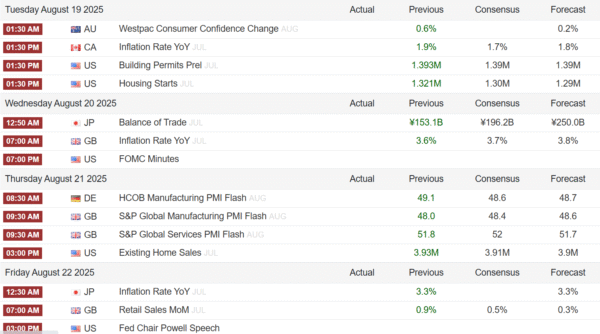

UK Inflation Jumps to 3.8% in July 2025, Highest in Over a Year

The UK inflation rate rose to 3.8% in July 2025, marking its highest level since January 2024. This was up from 3.6% in June and slightly above market forecasts of 3.7%, according to the Office for National Statistics (ONS). The main driver of the increase came from the transport sector, where prices climbed 3.2% compared … Read more

United States Stock Market Index & Housing Market Update – August 2025

Stock Market Overview US stocks saw limited movements on Monday, with major indexes holding near their record highs from last week. The S&P 500, Nasdaq 100, and Dow Jones Industrial Average all traded flat as investors awaited fresh catalysts, particularly from: Both are expected to offer hints on the Fed’s interest rate outlook. Trade these … Read more

Dollar Steady, Gold Gains as Trump Meets Zelenskiy | Fed Rate Cut Expectations Grow

The US Dollar Index (DXY) hovered around 97.8 on Monday, with investors balancing geopolitical risk and monetary policy signals. Traders are watching a pivotal meeting in Washington between US President Donald Trump and Ukrainian President Volodymyr Zelenskiy, alongside this week’s Federal Reserve Jackson Hole Symposium. Trump–Zelenskiy Meeting and Russia-Ukraine Peace Talks Markets are closely monitoring … Read more

Producer Prices Jump Most Since 2022. Initial Jobless Claims Fall to 224K.

The US Producer Price Index (PPI) for July 2025 surged 0.9% month-over-month, marking the sharpest increase since June 2022. This rebound from June’s flat reading easily beat market forecasts of a 0.2% rise, highlighting stronger-than-expected inflation pressures. Services costs led the gain, climbing 1.1% in July. The biggest driver was a 3.8% jump in margins … Read more

Trump Mocks Goldman Sachs CEO David Solomon: “Maybe He Ought to Just Focus on Being a DJ”

Former President Donald Trump took aim at Goldman Sachs CEO David Solomon on Tuesday, poking fun at his side gig as a DJ while blasting the bank’s past economic forecasts. “David Solomon and Goldman Sachs refuse to give credit where credit is due,” Trump wrote on Truth Social. “They made a bad prediction a long … Read more

Buffett Indicator Hits Record High of 208% — Is a Stock Market Crash Coming?

Key Points • A market valuation metric popularized by Warren Buffett is at an all-time high of roughly 208%.• Buffett has said that anytime this indicator approaches 200%, investors are “playing with fire.”• History has proven Buffett right in the past. Even after Warren Buffett steps down as CEO of Berkshire Hathaway (NYSE: BRK.A) (NYSE: … Read more

📈 Pound Sterling Jumps After Bank of England’s Surprise Hawkish Rate Cut

The British Pound surged against the Euro and US Dollar following the Bank of England’s August rate decision, defying market expectations of a more dovish tone. Despite cutting interest rates by 25 basis points to 4.00%, the Bank of England (BoE) surprised markets with a hawkish message—highlighting inflation risks and suggesting further rate cuts may not come as soon … Read more

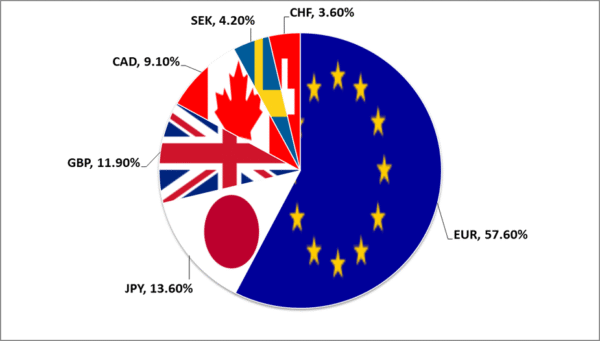

🌍 FX Market Update – August 6, 2025

Australian Dollar Leads Gains, Asian Currencies Slip The foreign exchange market saw notable movement today, with the Australian Dollar (AUD) emerging as the top gainer, while several Asian currencies faced pressure. Here’s a breakdown of the latest action: 🔼 Top Currency Gainers 🇦🇺 Australian Dollar (AUD) – +0.30% The AUD surged on the back of … Read more

UK Retail Sales Edge Up But Challenges Persist

Excerpt:The CBI’s retail sales index rose slightly in July 2025 but stayed weaker than expected, showing UK retailers are still battling tough economic conditions. Meanwhile, Hong Kong’s import growth slowed in June as demand shifted across sectors and trading partners. 📉 UK Retail Sales: Modest Improvement in July The Confederation of British Industry’s (CBI) latest … Read more