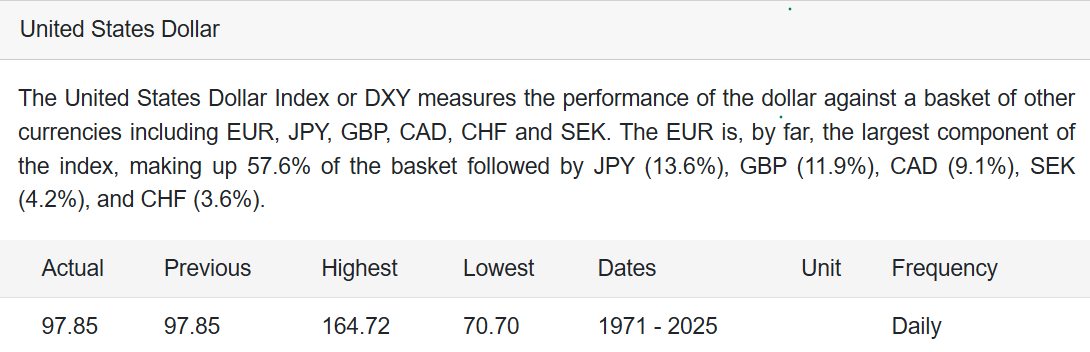

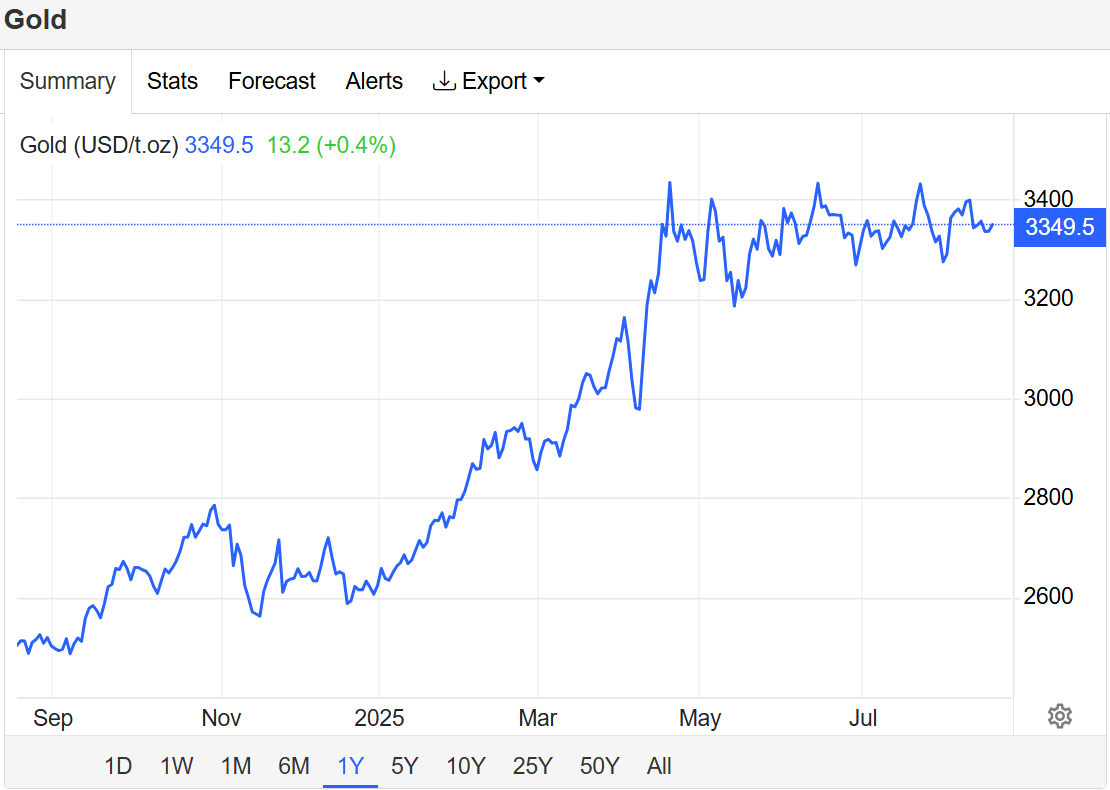

The US Dollar Index (DXY) hovered around 97.8 on Monday, with investors balancing geopolitical risk and monetary policy signals.

Traders are watching a pivotal meeting in Washington between US President Donald Trump and Ukrainian President Volodymyr Zelenskiy, alongside this week’s Federal Reserve Jackson Hole Symposium.

Trump–Zelenskiy Meeting and Russia-Ukraine Peace Talks

Markets are closely monitoring US efforts to push for a resolution in the Russia-Ukraine war.

- Trump said he would encourage Zelenskiy to pursue a “quick settlement,” building on his Friday talks with Russian President Vladimir Putin.

- While no ceasefire breakthrough was reached, Putin agreed to allow the US and Europe to provide Ukraine with security guarantees as part of a potential framework.

- The presence of European leaders at today’s Washington meeting signals growing urgency for a diplomatic path forward.

This geopolitical backdrop has supported safe-haven demand for gold while keeping the dollar steady.

Federal Reserve: Jackson Hole and September Rate Cut

Markets are pricing an 84% probability of a 25 basis point rate cut in September 2025, according to Fed funds futures.

- Stronger-than-expected US producer inflation and retail sales data have reduced the likelihood of a larger 50 bps cut.

- Fed Chair Jerome Powell is expected to give guidance at Jackson Hole later this week, while the minutes from the Fed’s last meeting will provide additional clarity on the path forward.

The outcome could shape the next big move for both the dollar and gold prices.

New Zealand Services Sector Still Weak

The latest BusinessNZ Performance of Services Index (PSI) showed the New Zealand services sector remained under pressure:

- PSI rose slightly to 48.9 in July from 47.6 in June, marking the sixth consecutive month of contraction.

- Sub-index breakdown: Activity/Sales (47.5) and Employment (47.1) contracted, while New Orders (50.0) were flat and Inventories (51.4) expanded.

- Business sentiment remains soft, with 58.5% of firms reporting negative conditions, though that’s an improvement from June (66.2%).

Firms cited weak demand, inflationary pressures, high interest rates, and global uncertainty as key challenges.

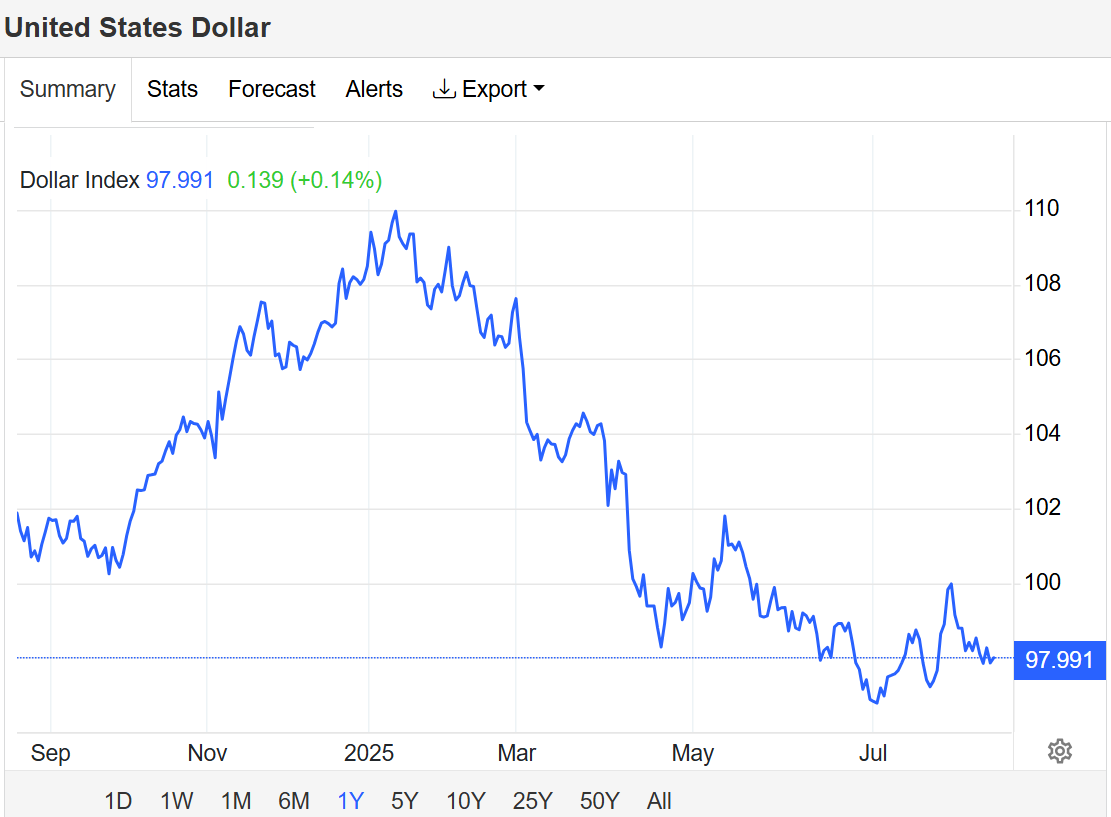

Gold Prices Rebound Above $3,350

After hitting a two-week low earlier in the session, gold prices recovered to $3,350 per ounce.

- The rebound was driven by safe-haven demand ahead of the Trump-Zelenskiy peace talks.

- Traders are also waiting for Powell’s Jackson Hole speech for direction on Fed policy.

If the Fed confirms a September rate cut, gold could gain further momentum in the weeks ahead.

📌 Key Takeaway

Global markets are treading cautiously as geopolitics and monetary policy dominate sentiment.

- The dollar is steady,

- Gold is rising,

- New Zealand’s services sector remains weak, and

- Investors await Powell’s guidance at Jackson Hole to gauge the Fed’s next move.